Why the 2017 Levy Swipe is a crime against our children… and my plan to repeal it!

Seven years ago, a horrible crime was committed in Olympia, Washington. It was a crime not only against one million children who attend our public schools, and a crime against more than two million homeowners in King and Snohomish counties, but also a crime against several sections of our State Constitution.

To understand this crime, we need to go back to the crime scene and re-enact this monstrous theft – a theft I call the Levy Swipe. This crime occurred a few minutes before Midnight on June 30, 2017. A vote was called on House Bill 2242 – a last minute 120 page bill that was only published the day before. The bill called for billions of dollars in new State taxes – the largest tax increase in State history. The bill promoters falsely claimed it would provide enough revenue to restore teacher pay to what it had been 20 years earlier – when in fact it did not provide any additional funding for our schools. Instead, it protected billions in tax breaks for wealthy corporations.

A few Senators, who were friends of mine, emailed me this bill at 10 pm on June 29th and asked me to analyze it. I stayed up all night and the next morning I reported to them that this bill was a Ticking Time Bomb. I explained that it would cause a record property tax increase of billions of dollars on homeowners in King and Snohomish Counties just to protect billions of dollars in tax breaks for some of the richest corporations in the history of the world. I also warned them that it would not actually increase school funding but instead would lead to the mass firing of thousands of teachers all across Washington state. These Senators then emailed my report to every member of our Legislature that same morning.

Pretend for a moment you are in the Legislature and it is your turn to vote on this Levy Swipe bill. Would you vote for a bill that forced a record tax increase on millions of homeowners - and the eventual firing of thousands of teachers – all to protect billions in illegal tax breaks for the richest corporations in the world?

Neither would I. Yet I am the only candidate running for State Superintendent who opposed this bill. All of my opponents who were in the legislature in 2017 voted for the Levy Swipe bill. One of them, Chad Magendanz, actually helped write the Levy Swipe bill.

Sadly, my predictions about the Levy Swipe have been proven correct. Property taxes skyrocketed in King and Snohomish counties by 60 to 70%. Yet despite this record $2 billion per year tax increase, in 2023 and 2024, school districts all across Washington State have been forced to make more than a billion dollars in budget cuts. As a result of these budget cuts, more than 3,000 teachers will be fired – the largest mass firing of teachers in State history – leading to a significant increase in class sizes in school districts all across our state. In this report, we will review how the McCleary Levy Swipe bill, led to this disastrous mass firing of teachers – and explain how to prevent another mass firing of teachers from occurring again in the future.

A School Funding Roller Coaster Ride during the past 7 years

In 2017, the Washington Legislature passed the McCleary Levy Swipe – robbing school districts of $2 billion in Local Levy funds and magically converting it into $2 billion in State funds. I warned at the time that the Levy Swipe would create a “ticking time bomb” that only temporarily increased school funding. I predicted that, in the long run, the Levy Swipe would lead to a Double Whammy of both huge property tax increases (the largest tax increase in state history) and the eventual firing of thousands of teachers.

Legislators who voted for the 2017 Levy Swipe claim that state support for school funding increased from $8000 per pupil in 2016 to $12,000 per pupil in 2022. But they ignore several important facts. First, after adjusting for inflation, the increase was only from $8,000 to 10,000 per pupil (with just over one million students, this is an increase of about $2 billion). Second, this $2 billion increase was done by stealing $2 billion in local levy funds and calling them state funds. Third, when homeowners voted in new local levies, their property taxes went through the roof.

The effect of the Levy Swipe was hidden and delayed for years because the Levy Swipe began with a deceptive “double taxation” year in 2018 which left high local property taxes in place for one year while adding a record increase in state property taxes in 2018. The Double Taxation year led to the illusion that school districts had lots of money. The double taxation year in 2018 only temporarily carried school districts through the 2019-20 school year.

A new gimmick was needed to hide the Levy Swipe Crime in the 2020-21 school year. The illusion of school funding was continued by a temporary infusion of $4 billion in federal emergency COVID funds. The federal funds were divided into four installments - $1.4 billion in the 2020-21 school year, another $1.2 billion in 2021-2022 school year, another $800 million in the 2022-23 school year and the remaining $400 million in the 2023-2024 school year.

The gradual loss of the federal emergency funds forced school districts to make $200 million in cuts in May 2021 for the 2021-22 school year and $400 million in cuts in May 2022 for the 2022-23 school year. Another $400 million in cuts were needed in May 2023 for the 2023-24 school year and a final $400 million in cuts will be made in May 2024 for the 2024-25 school year. We summarize these cuts by school district later in this report. But the important point is that the 2024-25 school year will be the first year when the Levy Swipe budget cuts will become fully visible.

A “Make Up” Pay Raise for Teacher in 2018 & 2019

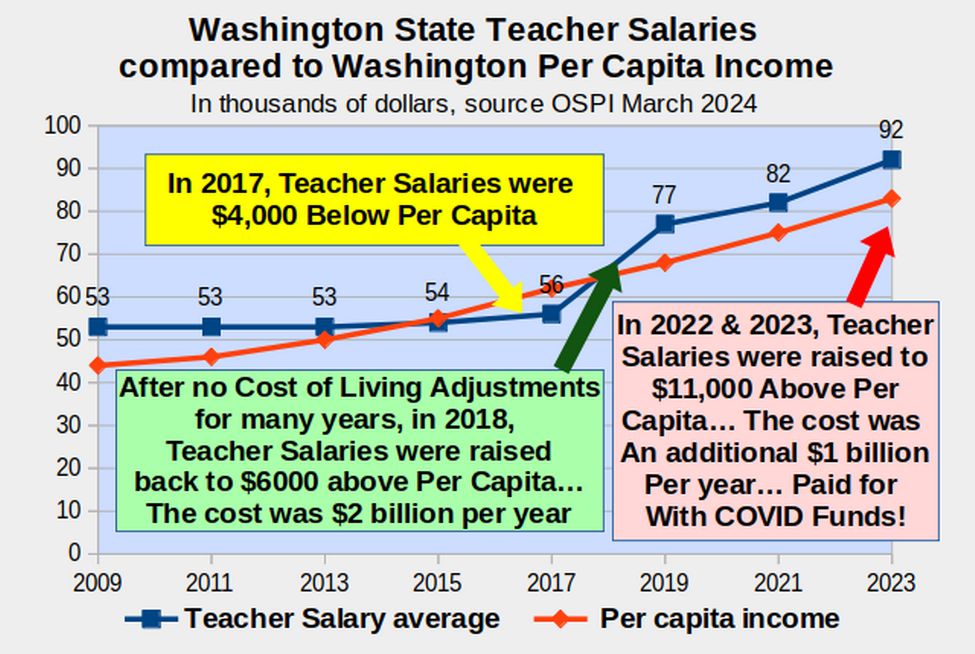

Teacher salaries historically have been about 10% above Washington Per Capita Income. 10% above Per Capita income is a good estimate of the average salary of people with advanced degrees. In Washington State, the average teacher is required to have a Master’s Degree. Per Capita income in turn is about 10% above the median income because a few wealthy billionaires skew the result.

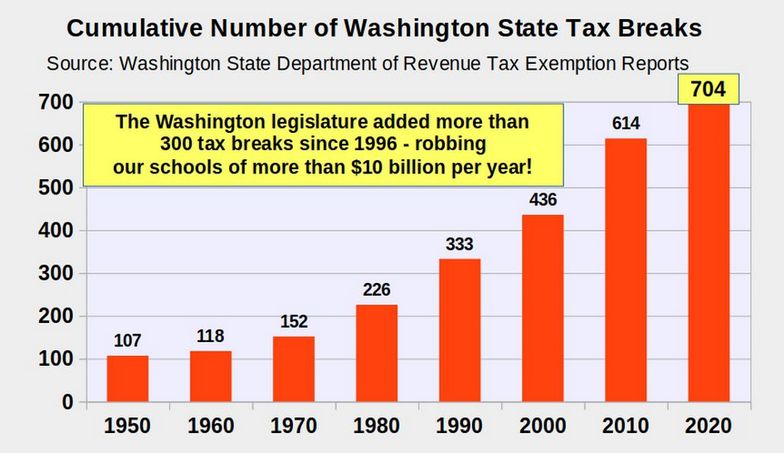

Sadly, beginning in 2003, the Washington State legislature began giving away billions of dollars in tax breaks to wealthy corporations like Microsoft and Boeing. These tax breaks for wealthy corporations are a violation of several sections of the Washington State Constitution.

These billions of dollars in illegal tax breaks were paid for by failing to give teachers “Cost of Living” Pay Increases for many years. This failure over a period of several years, lowered the salary of teachers to $4,000 below the Per Capita income by 2017:

Source: Pages 17 and 18 Tables 1 and 2 in this link:

https://ospi.k12.wa.us/sites/default/files/2024-02/allpersonnelsummaryreport2023-24.pdf

Please note that the above table refers to the average teacher salary. The beginning teacher salary is about $12,000 per year less than the average salary and it takes about 5 years to reach the average salary. This recognizes the fact that it takes about 5 years of experience for a teacher to become a truly effective teacher. At the same time, teachers with more than 10 years of experience are typically paid $12,000 above the average salary shown above.

In June 2017, the legislature passed the Levy Swipe Bill (House Bill 2242) which they claimed would raise school funding by $2 billion – but it did not because it merely took $2 billion in Local Levy funds and called them State funds. However, because 2018 was the “double taxation” year, with both the new high state levy and the old high local levies, there was temporarily $2 billion extra to bring teacher pay up to the State Per Capita income in 2018 and 2019.

This return to $6,000 above Per Capita income ended the McCleary lawsuit in 2018 – but led to monstrous tax increases - mainly in King and Snohomish counties. Now it was not teachers who were paying for the unconstitutional tax breaks to wealthy corporations – it was homeowners in King and Snohomish counties!

The cost was $2,000 to $3,000 per year in additional housing costs that were already far too high. Rents also went up dramatically as landlords passed on these property tax increases. So renters also paid for the Levy Swipe – which was therefore a factor that increased homelessness in King and Snohomish counties. But the real problem was that there was no actual increase in school funding other than Levy Swipe property tax scam.

This Ticking Time Bomb remained hidden for the 2020-21 school year as $1.4 billion in one time emergency federal funds kicked in. Had the COVID funds not magically appeared, there would have been a $1.4 billion school funding shortfall that year. As it was, the COVID funds were just enough to hide the fact that the Levy Swipe was a scam for one more year.

An Unwise and Unsustainable Raise in Teacher Pay in 2022 & 23

The truth about the Levy Swipe began to come out in the 2021-22 school year when COVID funding fell by $200 million to just $1.2 billion per year which forced school districts to make $200 million in cuts. In May 2022, school districts were hit by a Double Whammy. COVID funding fell by another $400 million to just $800 million per year. But to add insult to injury, the 2022 legislature passed a Teacher Cost of Living adjustment that was above the increase in Per Capita income (look closely at the chart above to see this). This unwise pay increase cost school districts another $500 million and the combination of declining COVID funds and rising teacher pay, forced school districts to fire thousands of teachers – and thereby increasing class sizes.

In May 2023, another Double Whammy occurred with COVID funding falling another $400 million to $400 million and the 2023 legislature again passing a a Teacher Pay increase that was far above the Per Capita income (look closely at the chart above to see this).

This unwise pay increase cost school districts another $400 million. The combination of declining COVID funds and rising teacher pay, forced school districts to fire thousands of additional teachers – and thereby increase class sizes even more.

In May, 2024, federal COVID funds will drop another $400 million to ZERO. For the first time since 2017, school districts will finally be forced to deal with the reality of the Levy Swipe. They will therefore have to fire thousands of additional teachers and thereby increase class sizes even more.

I want to be clear here. I fully support paying teachers near 10% above Per Capita income. I also fully support paying teachers Cost of Living Increases as well as extra pay for the cost of living in a high cost area like King County. I am not proposing that teachers be forced to live in the back of their car. But requiring school districts to pay teachers 10% above Per Capita income when there is no matching increase in State funds – which was the net effect of the 2022 and 2023 pay increases – simply leads to firing 10% of the teachers.

Simple math tells us that a 10% increase in teacher pay - with no long term increase in school funding - must lead to a 10% decline in the number of teachers and a 10% increase in class sizes (which are already among the highest in the nation). This is one of many reasons that thousands of teachers lost their jobs in 2023 and thousands more will lose their jobs in 2024.

Reykdal’s Insane WOKE policies led tens of thousands of parents to pull their kids out of our public schools

School districts have also lost huge numbers of students as parents pull their kids out of school because they were opposed to the Reykdal’s insane WOKE policies, Mask Mandates and Zoom classes. Enrollment is down 4% across the state. In Snohomish County, enrollment is down 5,000 students from 2019-2020 to 2021-22. That’s a loss of $50 million. In Mukilteo, the district lost 630 students, or the equivalent of an entire elementary school. Puyallup lost 450 students. The solution to this problem is to honor our State Constitution which requires local control of our schools. As State Superintendent, on Day 1, I will declare all of Reykdal’s WOKE policies to be in violation of our State Constitution and allow school districts to listen to parents again.

Massive Inflation during the Past Four Years

During the past four years, school districts have faced massive inflation in several areas. These include food, energy and insurance prices all of which have more than doubled during the past four years. These huge increases together with the huge decline in student enrollment has added a further $100 million per year burden on school districts which is why actual budget cuts in May 2023 and 2024 were over $500 million in 2023 and 2024 even though the loss in federal COVID funds was only $400 million in 2023 and 2024.

The Net Result is both High Property Taxes, Massive School Budget Cuts and Thousands of Teachers being fired

In May 2023, more than 50 school districts were forced to cut 500 million dollars and fire thousands of teachers and support staff. In May 2024, more than 100 school districts will be forced to cuts another 500 million dollars - firing thousands more teachers and support staff. The total cuts over the past two years will be more than one billion dollars.

Here is some of the announced cuts in many school district made in May 2023 and again in May 2024: Seattle school district $105 million in May 2024 after making $100 million in cuts in May 2023. The result will be fewer schools (closing more than two dozen schools), fewer teachers and larger class sizes. Vancouver school district cutting $35 million. 261 positions including 50 elementary teachers and 63 secondary teachers. Evergreen School district cutting $20 million in May 2024 after cutting $20 million in May 2023. 140 staff will be cut including 20 elementary teachers and 50 secondary teachers.

Here is a table of school districts budget cuts in May 2023 & 2024:

|

School District |

Two year Budget Cut in Millions |

Two year estimate of Teachers Fired |

|

Seattle |

105 x 2 = $210 |

330 x 2 = 660 |

|

Everett |

38 x 2 = $76 |

130 x 2 = 260 |

|

Vancouver |

35 x 2 = $70 |

120 x 2 = 240 |

|

Kent |

31 x 2 = $62 |

115 x 2 = 230 |

|

Mukilteo |

25 x 2 = $50 |

75 x 2 = 150 |

|

Northshore |

21 x 2 = $42 |

63 x 2 = 126 |

|

Evergreen |

20 x 2 = $40 |

60 x 2 = 120 |

|

Bellingham |

16 x 2 = $32 |

48 x 2 = 96 |

|

Tacoma |

15 x 2 = $30 |

45 x 2 = 90 |

|

Lake Washington |

15 x 2 = $30 |

45 x 2 = 90 |

|

Puyallup |

14 x 2 = $28 |

42 x 2 = 84 |

|

Shoreline |

14 x 2 = $28 |

42 x 2 = 84 |

|

Peninsula |

12 x 2 = $24 |

36 x 2 = 72 |

|

Edmonds |

12 x 2 = $24 |

36 x 2 = 72 |

|

Renton |

11 x 2 = $22 |

33 x 2 = 66 |

|

Issaquah |

11 x 2 = $22 |

33 x 2 = 66 |

|

Bellevue |

10 x 2 = $20 |

30 x 2 = 60 |

|

Olympia |

10 x 2 = $20 |

30 x 2 = 60 |

|

Highline |

8 x 2 = $16 |

24 x 2 = 48 |

|

Central Kitsap |

7 x 2 = $14 |

21 x 2 = 42 |

|

Camas |

6 x 2 = $12 |

18 x 2 = 36 |

|

Auburn |

4 x 2 = $8 |

12 x 2 = 24 |

|

Tumwater |

4 x 2 = $8 |

12 x 2 = 24 |

|

Bainbridge Island |

4 x 2 = $8 |

12 x 2 = 24 |

|

Snoqualmie Valley |

3 x 2 = $6 |

9 x 2 = 18 |

|

Woodland |

3 x 2 = $6 |

9 x 2 = 18 |

|

Washugal |

3 x 2 = $6 |

9 x 2 = 18 |

|

Lynden |

3 x 2 = $6 |

9 x 2 = 18 |

|

Blaine |

2 x 2 = $4 |

6 x 2 = 12 |

|

Longview |

2 x 2 = $4 |

6 x 2 = 12 |

|

North Kitsap |

2 x 2 = $4 |

6 x 2 = 12 |

|

Sequim |

2 x 2 = $4 |

6 x 2 = 12 |

|

Mount Baker |

1 x 2 = $2 |

3 x 2 = 6 |

|

TOTAL |

469 x 2 = $938 million |

1407x 2 = 2814 teachers |

A record number of school districts are now on the verge of bankruptcy. Marysville, La Conner and Mount Baker are all facing bankruptcy. All three have been forced to borrow against future revenue. Marysville needed a $5 million loan just to get through the school year. Marysville is facing $17 million in cuts.

How do we fund our schools without placing a monstrous property tax burden on homeowners in King and Snohomish Counties?

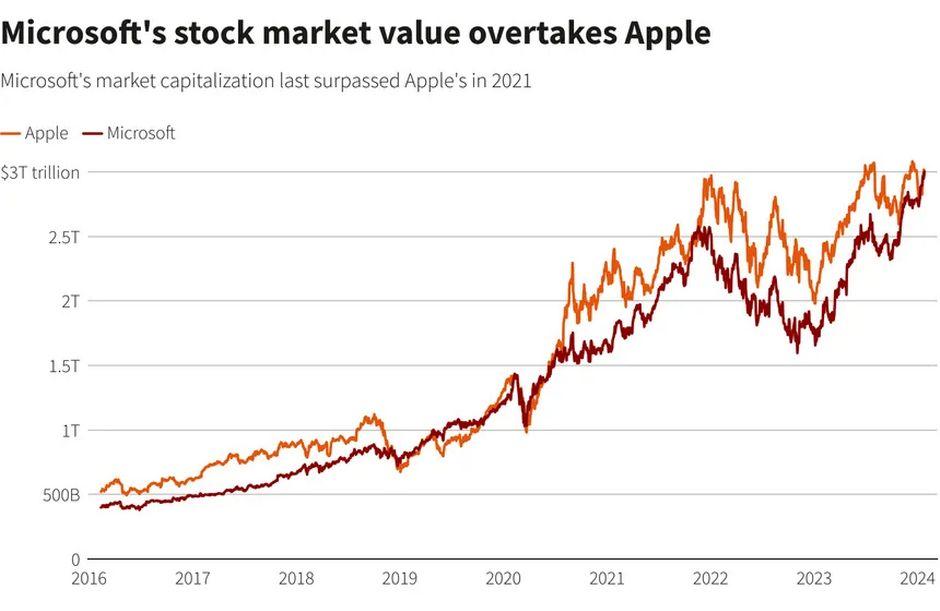

The 2017 Levy Swipe illegally increased property taxes on homeowners in Snohomish County by just under $1 billion dollars per year and illegally increased property taxes on homeowners in King County by just under $2 billion per year. So we need to find $3 billion per year to replace the Levy Swipe funds. The most obvious place to get the first billion dollars a year is by repealing the illegal Microsoft Tax break.

The Levy Swipe scam was hatched by two of Bill Gates top assistants, Democrat Ross Hunter and Republican Chad Magendanz. The purpose of the Levy Swipe was to protect billions of dollars in illegal tax breaks for corporations like Microsoft that basically control Olympia.

The Microsoft Tax break lets Microsoft pretend they are located in Reno Nevada instead of Redmond Washington. So the real reason property taxes were jacked up on homeowners in King and Snohomish counties was to protect billions of dollars in tax breaks for the richest corporation in the history of the world.

Is there anyone who actually believes that a corporation worth THREE TRILLION dollars can not afford to pay their fair share of state taxes? Or that it is fair to shift the Microsoft tax burden to parents struggling to raise their families in King and Snohomish counties?

The Microsoft tax break is only one of 700 tax breaks that rob the rest of us tax payers of about $25 billion per year. All of these tax breaks are illegal because they violate several sections of our State Constitution.

Why Tax Breaks are Prohibited by our State Constitution

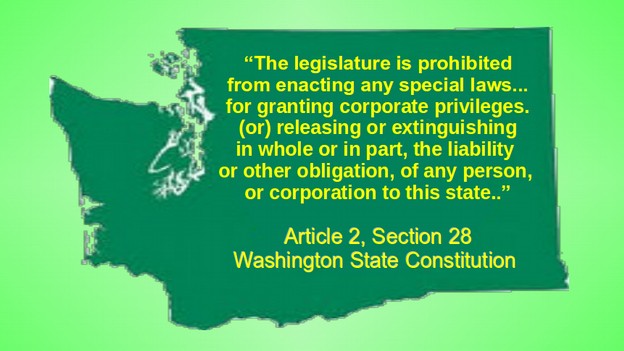

Throughout the State Constitution, there are several clauses that indicate that granting tax breaks to private corporations is unconstitutional. Here are just three of those clauses.

Article 2, SECTION 28 SPECIAL LEGISLATION. The legislature is prohibited from enacting any private or special laws... Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

Every tax break passed by the Washington legislature is a clear violation of Article 2, Section 28 of our State Constitution.

No other state in the nation grants tax breaks to wealthy corporations to the extent that the Washington legislature has granted tax breaks to wealthy corporations. The total amount of lost tax revenue these 700 exemptions account for is now more than $25 billion per year. In granting 700 tax exemptions, some of which apply to only a single corporation, such as Microsoft or Boeing, our state legislature has created laws that clearly violate the uniformity clause of Article 7, Section 1 of our State Constitution. These special tax breaks are not legal even if the Constitution did not have a Paramount Duty clause. But when we also consider the Paramount Duty clause and how hard the drafters of our State Constitution worked to prevent corporate corruption in our state, the existence of these 700 illegal tax breaks adds insult to injury.

Why Corporate Tax Breaks are a Crime Against our Children

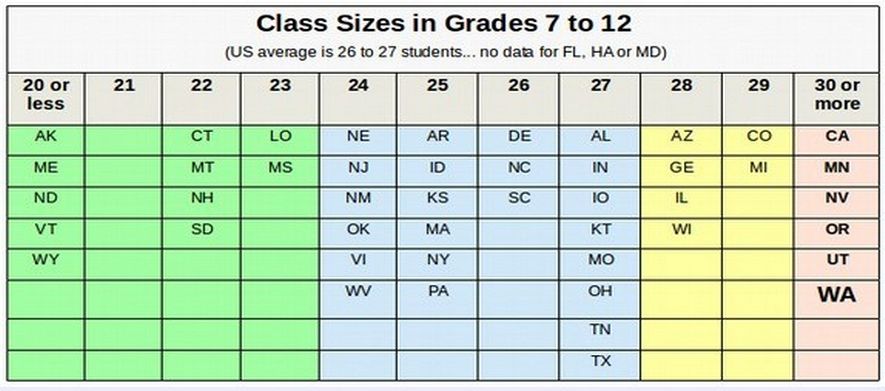

To pay for these corporate tax breaks, the legislature failed to provide school districts with the funds needed to hire more teachers to keep up with increasing enrollments. As a consequence, over time, class sizes in Washington state increased to among the highest in the nation. As a consequence of having the highest number of corporate tax breaks in the nation, our kids were (and still are) forced to deal with the highest class sizes in the nation. In 2011, the average class size in Washington state was nearly 30 students. Here is a distribution of class sizes showing which states have low, average, above average or extremely high class sizes: https://nces.ed.gov/programs/digest/d13/tables/dt13_209.30.asp

The problem with high class sizes is that struggling students do not get the help they need and teachers suffer from nervous breakdowns:

The Solution to the School Funding and Property Tax Crisis

The 2017 Levy Swipe plan was adopted to protect 700 illegal corporate tax breaks totaling more than $25 billion. All of these tax breaks are contrary to several sections of our state constitution. But merely repealing a small fraction of these tax breaks would allow us to roll back property taxes to what they were before the levy swipe – saving homeowners thousands of dollars a year in property taxes – AND increase school funding by $1 billion a year – allowing us to rehire the thousands of teachers who were fired due to the loss of a billion dollars in federal funding. My proposal to increase school funding by a billion dollars includes a clear provision that never again would school districts be allowed to use one time emergency funds to raise teacher pay. Teacher pay increases must be offset by equal reductions in corporate tax breaks.

As always, I look forward to your questions and comments.

Regards,

David Spring M. Ed.

David (at) SpringforBetterSchools (dot) org