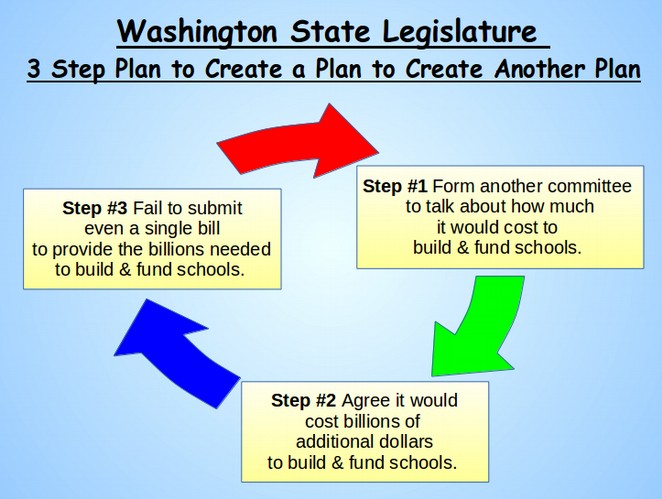

Our campaign, Spring for Better Schools, is about much more than just getting votes to win this election for Superintendent of Public Instruction. Our goal is to provide information to parents and teachers about the crisis facing our public schools here in Washington state due to two decades of neglect by our state legislature. Our hope is to build a Coalition of the Caring to fully fund our public schools. Our plan is to organize and empower a movement to replace corrupt legislators with folks who will honor our state constitution by funding our public schools even without a direct order from our Supreme Court.

In this article, we will explain how the Washington legislature is so corrupt that they have risked the health and safety of half a million students in order to keep the gravy train of billions in tax breaks going for wealthy multinational corporations. The shocking fact is that half of Washington's 2,000 schools are so old and run down that they do not meet either the health codes or the earthquake codes. That's right. The Washington legislature is willing to kill and injury thousands of our kids to protect billions in tax breaks for Microsoft and Boeing.

Why are the health codes important?

In the past few months, we have read about thousands of children in Flint Michigan who were essentially poisoned by a corrupt government that refused to provide those kids with a safe source of drinking water. Sadly, the Washington State legislature has also refused to come up with the funds needed to provide safe drinking water at schools here in Washington state. And it is not just the water. Many older schools suffer with major mold problems. Instead of coming up with billions of dollars needed to provide students with healthy schools, the corrupt Washington legislature has "exempted" our schools from the health codes!

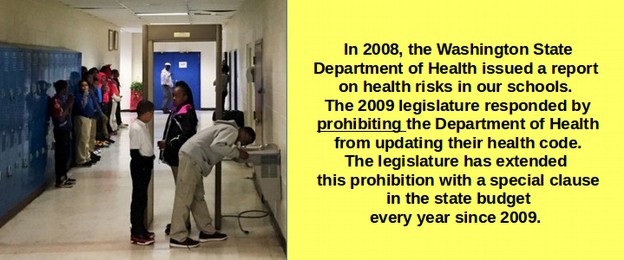

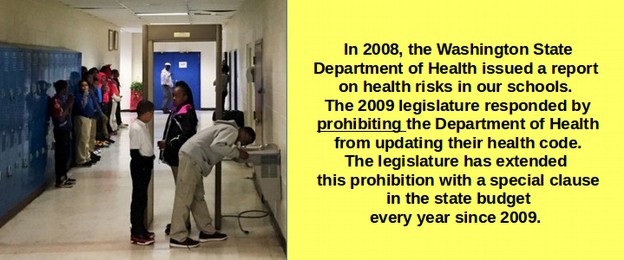

Specifically, after a shocking report on drinking water and other health hazards in our public schools by the State Health Department, the 2009 legislature responded to this health crisis by including a clause in the final 2009-11 operating budget, passed April 24 2009 as ESHB 1244, in Section 222 prohibiting the State Department of Health from implementing any new or amended school facility health safety rules without approval of the legislature.

http://sboh.wa.gov/OurWork/Rulemaking/SchoolsEnvironmentalHealth

Who voted for this draconian bill prohibiting the State Department of Health from adopting new safety rules even after the Department of Health sent a specific letter about the health problems of our public schools? Representative Larry Seaquist - one of the candidates now running for Superintendent of Public Instruction. Who was the most vocal proponent of protecting the health of our students back in 2009? That was me. I wrote numerous reports on the health problems facing our public schools summarizing the finding from the Washington State Department of Health public hearings on school health.

Half of our schools have water damage (which leads to mold and other toxins). Half have poor air quality. Thirty percent of our schools are estimated to have excessive lead in the water (which causes brain damage in children). Most of these problems are related to older schools. Half of our schools are more than 50 years old.

One mother, Odele La Lemond testified about how her bright, engaged child, deteriorated before her eyes. At one point, her daughter could not remember where her bedroom was after returning from a trip. Other symptoms included extreme fatigue, vocabulary loss, headaches, bellyaches, dizziness, and loss of balance. Drinking water in her classroom was found to contain elevated levels of lead.

One parent asked: “I know it will cost money to have safe drinking water in our schools. But how much is a child’s life worth?”

Here are some shocking facts about the lack of health standards in our schools. The original school health rule "suggested" that schools be inspected by the county health department periodically. Unfortunately, most counties simply ignore the old rule. Thus, in many counties, there is absolutely no one checking on schools to make sure they are safe.

The new proposed new school health rule would require that each county health department periodically inspect schools to make sure they are safe - just as health department inspectors check on restaurants to make sure they are safe. Legislators, including Seaquist and Reykdal, have blocked the new rule from being implemented by including a special clause in the state budget every year which prohibits the State Department of Health from implementing the new rule.

Why prohibit schools from being inspected? Because every legislator in Olympia knows that our schools do not meet health standards. But they do not want an inspector documenting these problems with mold and unsafe drinking water because the public would then become outraged - just as they are outraged in Flint Michigan - and then the legislature would be forced to spend billions of dollars replacing old crumbling and unhealthy schools.

As Superintendent, I will immediately implement the recommended rules of the Washington State Department of Health. Our kids have a constitutional right to attend a safe and health school. The failure of the Washington State legislature to provide funding for safe drinking water and air quality in our schools is one more example of why I have concluded that our current state legislature may be one of the most corrupt legislatures in the nation.

Why are the earthquake codes important?

On April 16 2016, a Magnitude 7.3 quake struck Japan killing dozens and injuring thousands. A few hours later, a Magnitude 7.8 quake struck Ecuador killing hundreds and injuring thousands more. Thousands of families are now camping in the streets without water or homes. As bad as these quakes were, the fact is that Washington state is at extremely high risk of a Magnitude 9 earthquake sometime in the next few years.

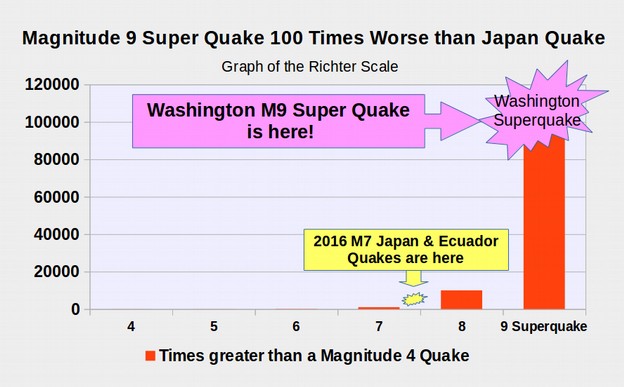

Understanding the Richter scale

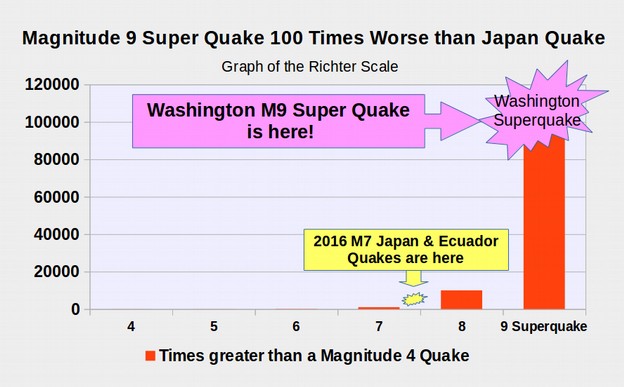

The Richter scale is a scale based on multiples of ten. Thus a Magnitude 5 quake is ten times worse than a Magnitude 4 quake and a Magnitude 6 quake is 100 times worse than a Magnitude 4 quake. This makes the Japan 7.3 quake about 1000 times worse than a Magnitude 4 quake and it makes the the Ecuador quake about 10,000 times worse than a Magnitude 4 quake. But a Magnitude 9 quake, commonly called a Super Quake, will be more than 10 times worse than the quake that struck Ecuador two days ago and 10,000 times worse than a Magnitude 4 quake. Here is a visual graph of the Richter scale with a Magnitude 4 quake set for 1.

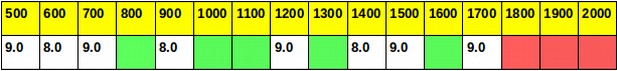

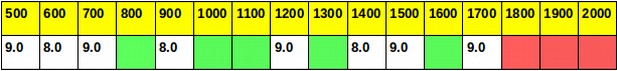

The last time Washington suffered a Magnitude 9 quake was just over 300 years ago in January 1700. Magnitude 9 Mega Quakes have occurred a total of 5 times since 500 – a rate of once every 300 years. Research into the pattern of these Super Quakes shows they strike Washington about every 300 years - meaning we are already overdue for another Magnitude 9 earthquake. Here is the pattern since 500 AD.

As you can see, at more than 316 years of quiet, we are already in the longest period of quiet between Mega Quakes during the past 1500 years. The last time there was this long of a quiet spell was in 200 AD to 500 AD. This last long quiet period between 200 AD and 500 AD was followed by two 9.0 quakes and one 8.0 quake in just 200 years between 500 AD and 700 AD.

Because half of our 2,000 schools are more than 50 years old and do not meet the earthquake codes, about 1,000 schools will be destroyed in a Magnitude 9 Super Quake. If this happens on a school day, as many as 500,000 students could be killed or injured. The clock is ticking. Every day this problem is not addressed, the danger to our kids grows even higher. This is without a doubt the gravest safety risk to children in the history of our nation. What is the Washington legislature doing about it? Absolutely nothing!

While both Oregon and British Columbia are at least trying to improve the safety of their schools, the Washington state legislature has done absolutely nothing to improve the safety of our schools. Instead, they claimed that they do not have the $30 billion it would take to replace 1,000 schools. Yet in just three days, they were able to fund $9 billion to give Boeing. Even worse, the legislature actually gives away $30 billion per year in tax breaks. Suspend these illegal tax breaks for even one year and we could have 1,000 safe schools the very next year. Hopefully, these facts will help you understand why I claim that the Washington state legislature is the most corrupt legislature in the nation.

We will provide more analysis of this Super Quake danger to students in Washington state in a moment. But first we will provide a summary of the shocking lack of funding for school construction in Washington state in the past 20 years and how this lack of funding has led to a $40 billion school construction crisis.

Washington State $40 Billion School Construction Crisis

While a great deal has been written about the failure of the Washington State legislature to fully fund the operation of public schools, fully funding school construction and repair is by far the greatest need being ignored by our state legislature.

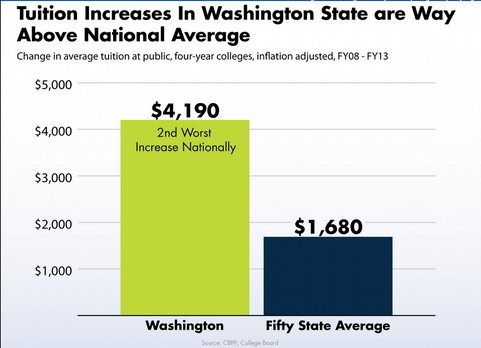

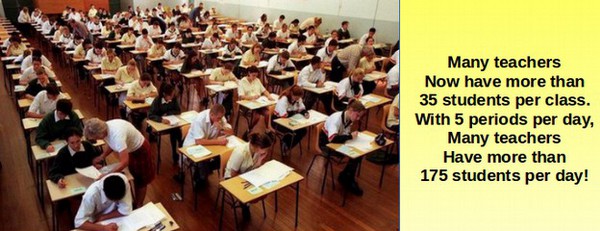

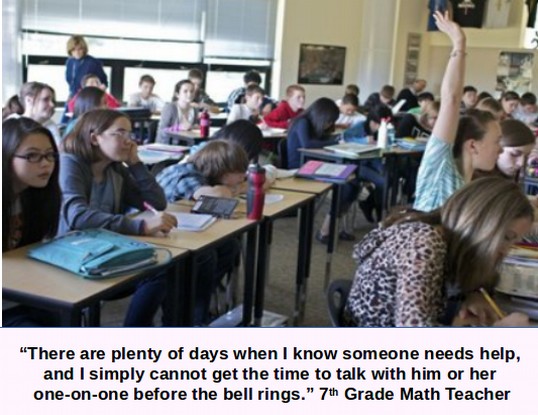

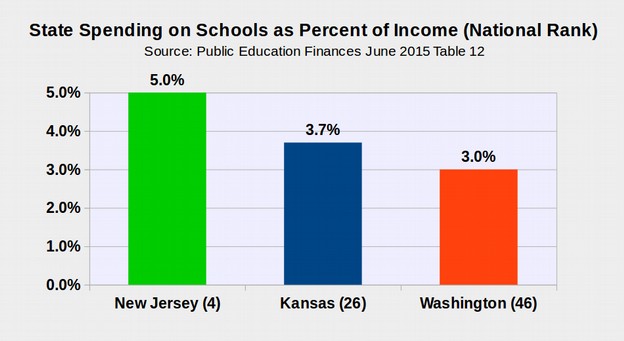

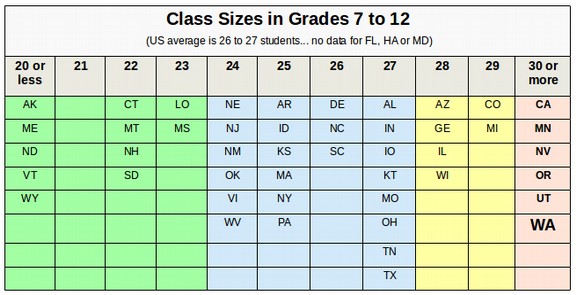

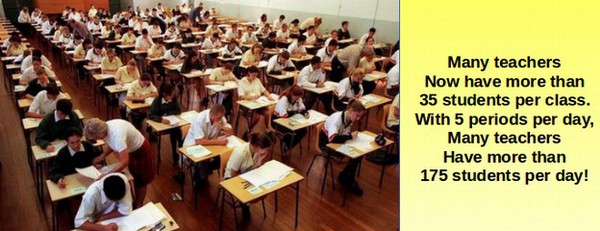

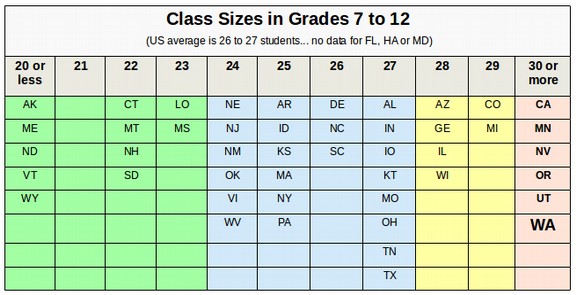

Washington State is near the bottom of the nation in school operation funding as a percent of state income - which is why class sizes in Washington state are near the highest in the nation. It would take about $8 billion per year in additional state revenue to restore school funding and cut class sizes in half.

However, the shortfall in school construction and repair spending is now more than $40 billion – almost 5 times greater than the shortfall in school operation spending. As a consequence, Washington state has one of the highest rates of “unhoused students” in the nation. Restoring school operation and construction funding must both be done at the same time. It does no good to hire 40,000 additional teachers to cut class sizes in half unless we also build 40,000 additional classrooms for those teachers and their students to learn in. Sadly, the Washington State legislature has underestimated school construction and repair costs by more than $2 billion per year – for more than 20 years – leading to a school construction and repair backlog of more than $40 billion. Our plan is to invest $4 billion per year over a 10 year period – and pay for the increase in school construction and operation funding by repealing a tax break now used by billionaires to avoid paying their fair share of state taxes.

Why the State Legislature – Not Local Home Owners – is Responsible for Building and Repairing Public

Some in the State legislature claim that it is up to local homeowners to pass bonds to build public schools – that the State legislature is only responsible for hiring teachers. However, our Supreme Court has repeatedly stated that the legislature must provide 100% of the actual cost to build, repair and operate our public schools.

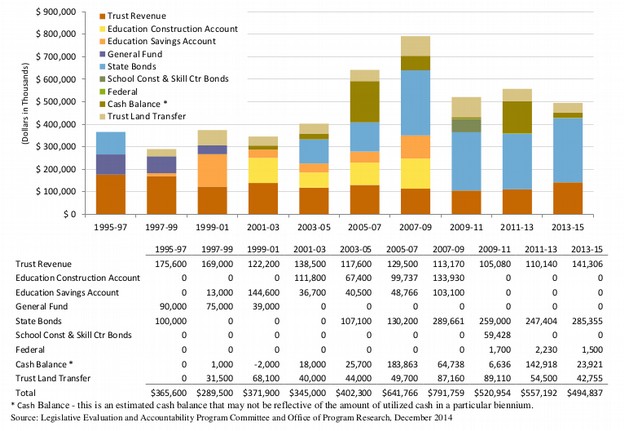

Decades of Decline in School Construction Funding

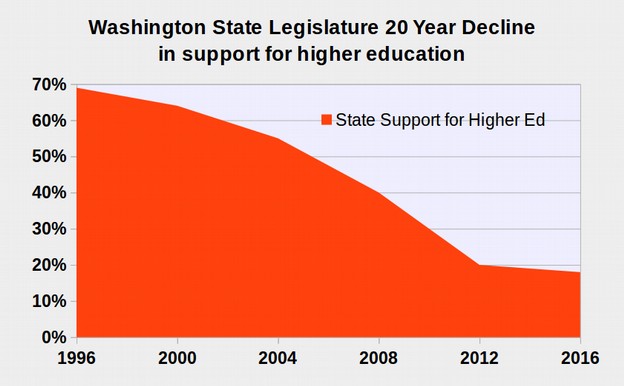

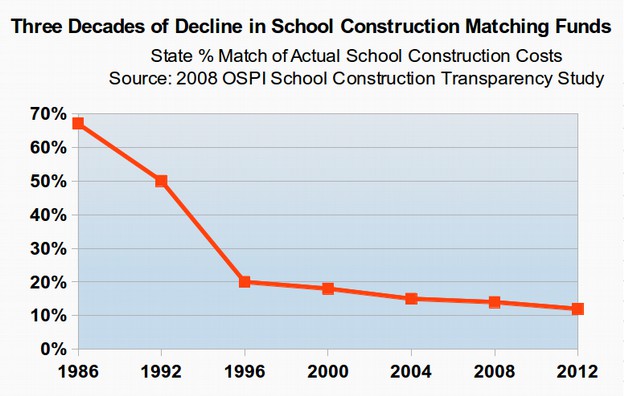

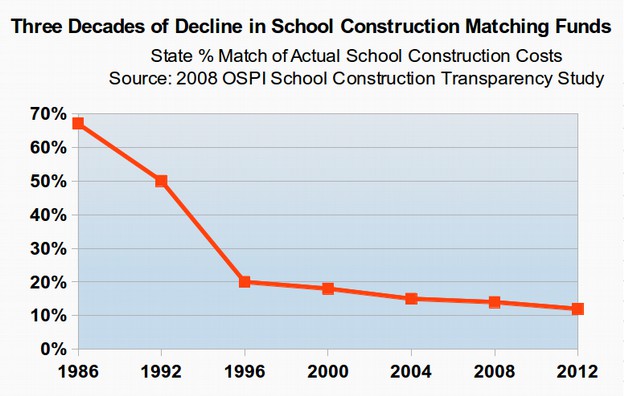

For more than two decades, our legislature has refused to pay more than a small fraction of the actual cost of building and repairing schools. Whereas our State legislature historically provided more than 66% of the actual construction costs of public schools, State funding for school construction has fallen to below 10% of actual costs during the past 20 years.

We will need to hire 40,000 additional teachers to cut class sizes in half. Obviously, this will require building 40,000 additional classrooms. Sadly, not only has our legislature failed to provide adequate funds for operating schools, but they have also failed to supply funds for the repair and building of schools.

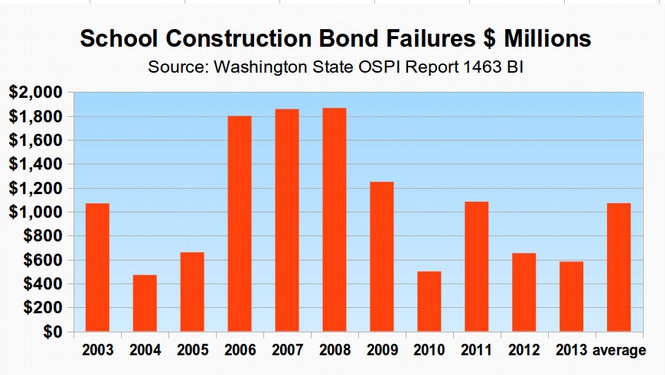

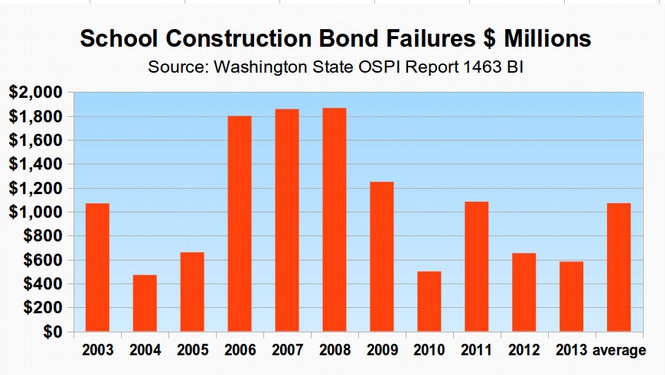

Instead, the Washington state legislature has shifted the responsibility for building and repairing schools onto the backs of local homeowners (just as they have illegally shifted the cost of operating schools onto the backs of local homeowners by raising the levy lid). This failure by the state legislature to fund school construction has led to more than 11 billion dollars in school bond failures during the past 11 years. The decline in State Matching funds has resulted in a transfer of this funding burden from the State to local home owners via an increasing dependence on local school construction bonds. Like with operating costs, the State’s failure to help fund school construction has led to a dramatic increase in local school bond and levy costs which in turn have led to a rapid rise in local property taxes.

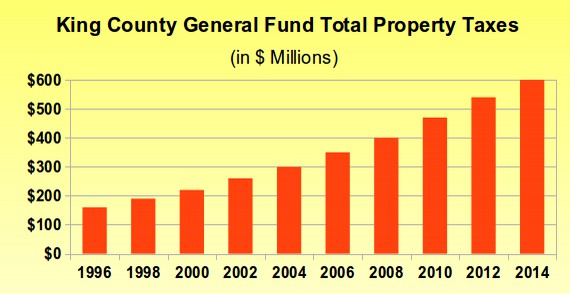

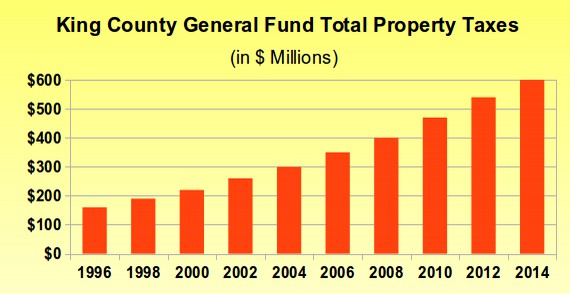

This unfair property tax burden increase on middle class homeowners is as high as $2,000 additional dollars per year on the average home in King County. For example, in 2014, residents in King County paid on average $4,507 annually in property tax. This is more than twice what we paid in property taxes in 1996. This dramatic rise in property taxes can best be seen in the chart of total King County Taxes since 1996. The total property tax collected has more than tripled even as funding for schools and other services have been slashed:

Source: 2015-2016 King County Issue Paper General Fund Financial Situation

http://kingcounty.gov/exec/PSB/Budget/2015-2016.aspx/2015-16Issue_Paper-GenFundSit.pdf

By rolling back these property taxes to what they were in 1996, the average homeowner in King County would save more than $2,000 per year.

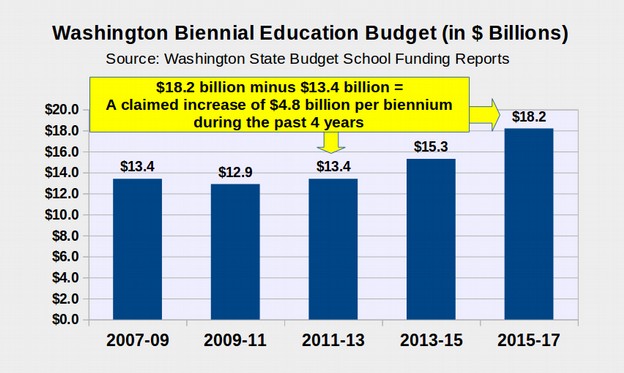

Washington Supreme Court Orders the State Legislature to Comply with our State Constitution

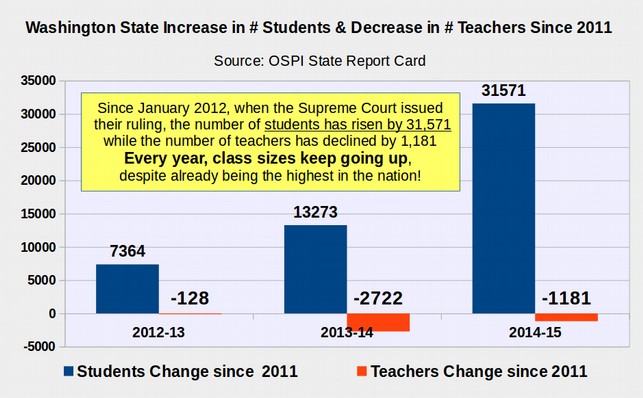

In January 2012, the Washington State Supreme Court ruled that the State legislature had failed to adequately fund our public schools. The Supreme Court gave the State legislature 5 years – until September 2017 - to comply with our State Constitution. Sadly, our State legislature ignored this Supreme Court order during the 2012, 2013 and 2014 legislative sessions. In September 2014, the Supreme Court found the State Legislature in Contempt of Court for failing to make steady progress towards fully funding public schools. In 2015, the State legislature again failed to make steady progress towards fully funding public schools. Therefore in August, 2015, the Washington Supreme Court sanctioned the State legislature by assessing fines for failure to fully fund our public schools. Despite these sanctions, the legislature continues to ignore their constitutional obligation to fully fund school construction, repair and operation.

Follow the Money!

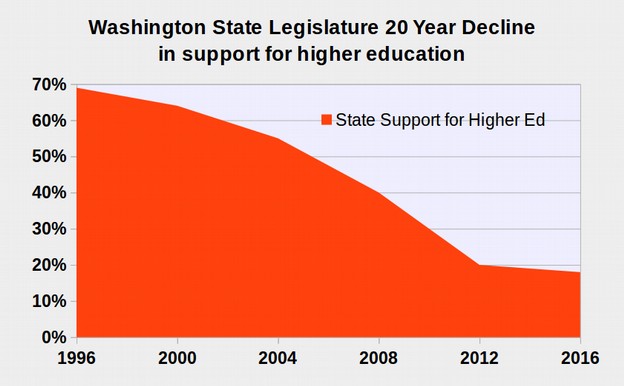

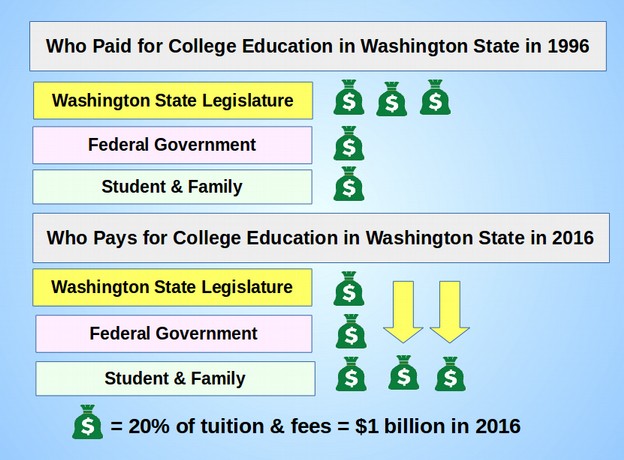

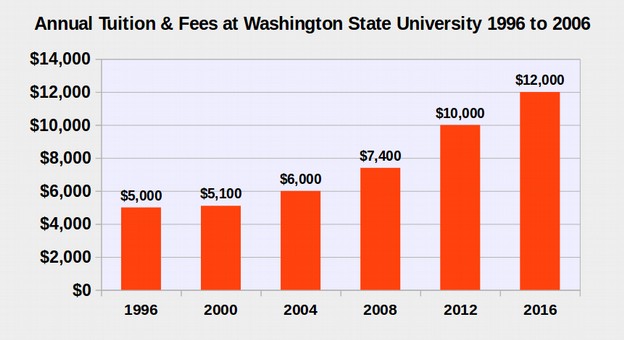

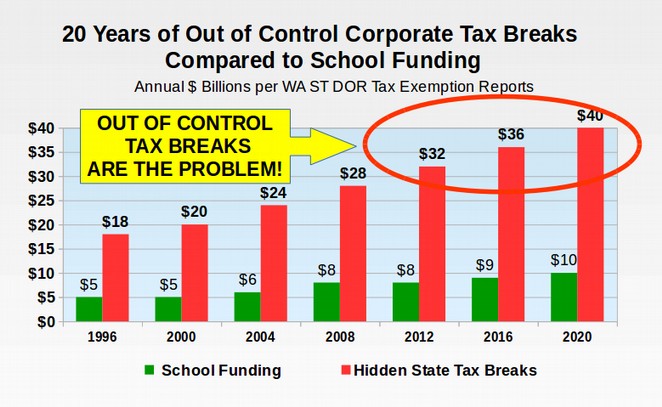

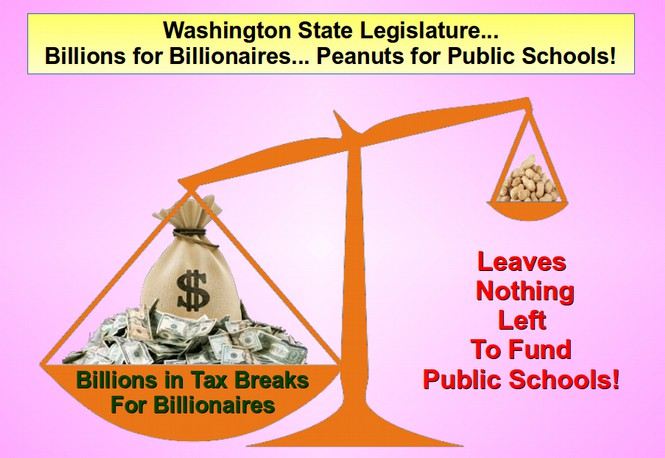

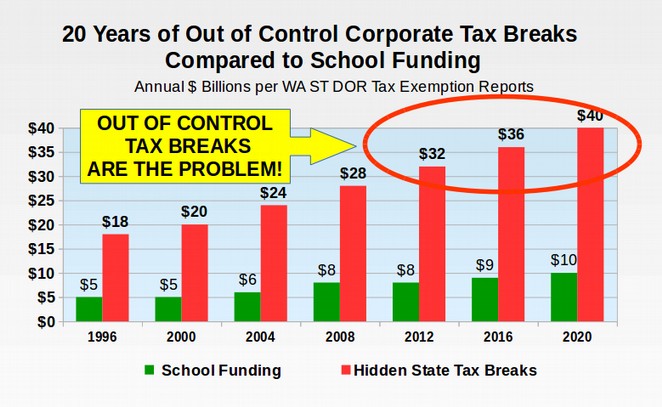

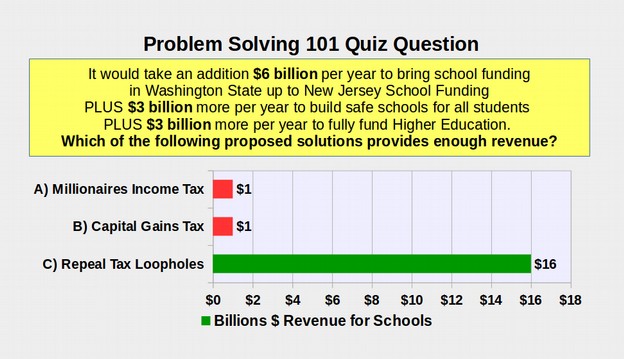

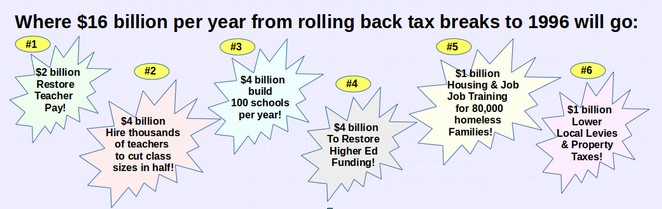

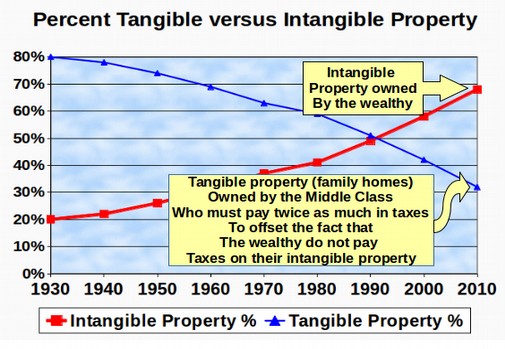

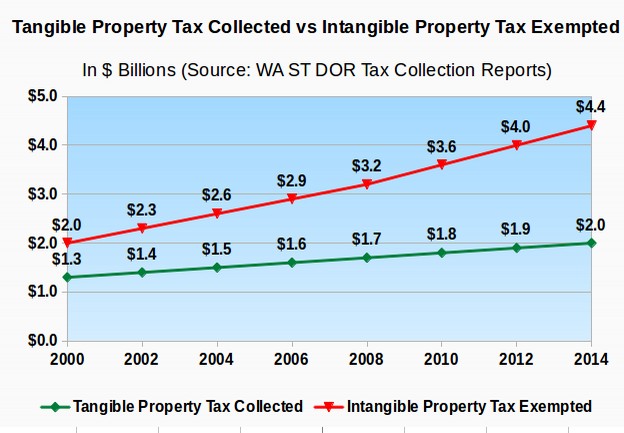

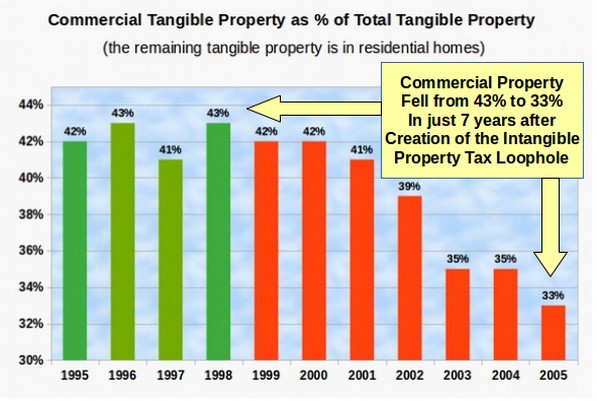

The legislature claims that they do not have the money to fund our schools. But everyone in Olympia knows where the money went that used to be invested in our public schools. In the 1980s, our State was 11th in the nation in school funding. However, since then, as the following charts show, tax breaks for billionaires and wealthy multinational corporations have skyrocketed to more than $30 billion per year – at the same time that state revenue and school operation funding have plunged to near the lowest in the nation. We propose rolling back these tax breaks for the rich by 20% in order to restore school operation and construction funding.

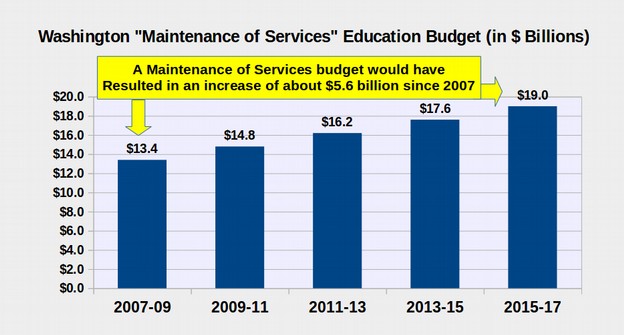

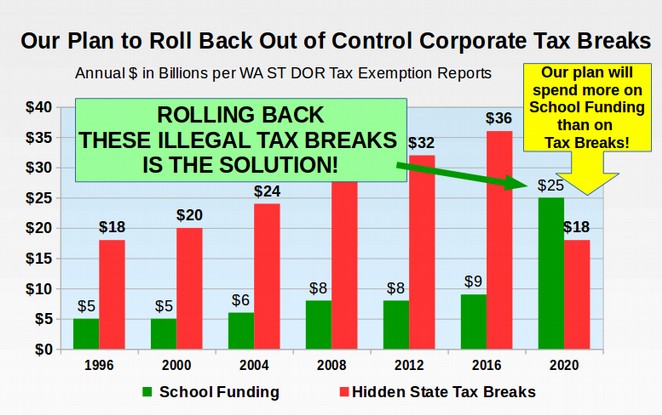

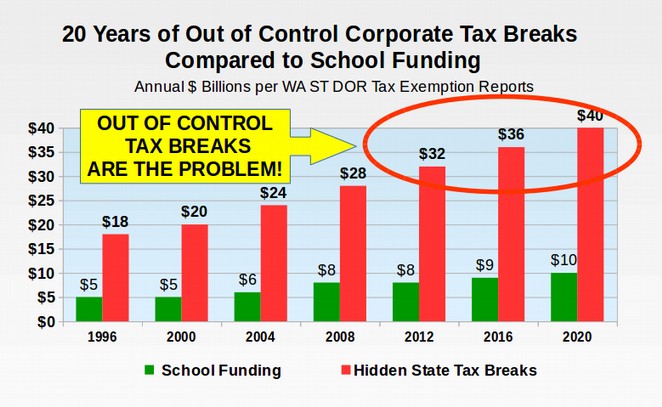

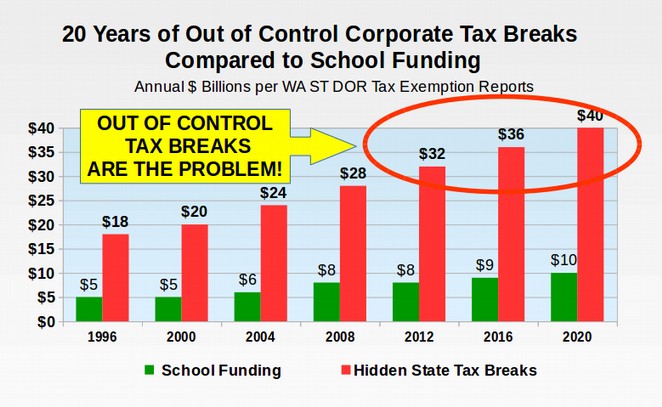

Here is the increase in tax breaks during the past 15 years:

You can see that tax breaks for the wealthy are about four times greater than school funding for our state's one million school children. Since 2000, tax exemptions have increased by $16 billion from $20 to $36 billion while school funding has increased by $4 billion from $5 to $9 billion. We propose reducing tax exemptions by $16 billion per year - rolling them back to what they were in 1996 – so that we can increase school construction and operation funding by $12 billion per year.

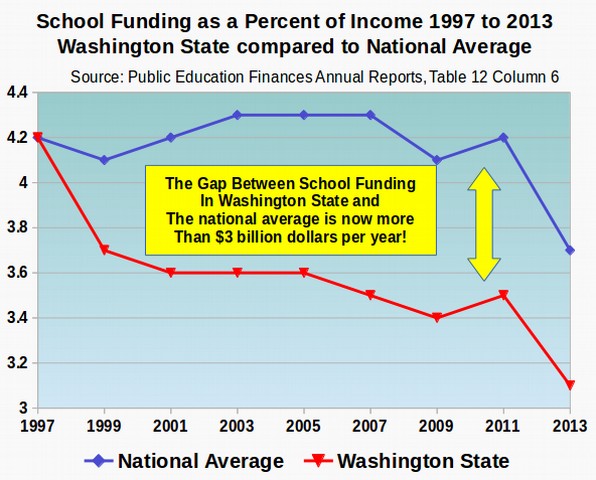

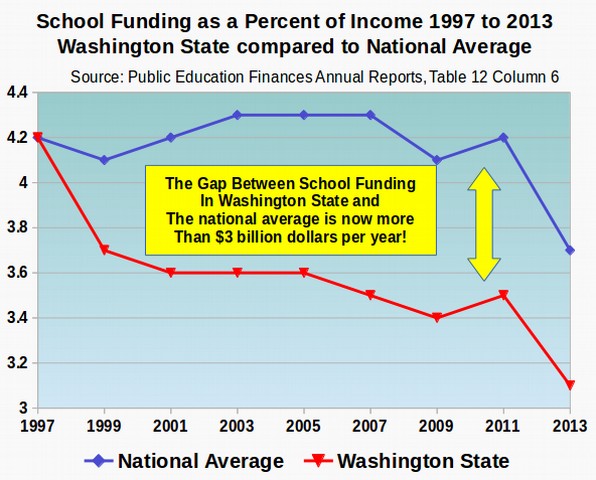

While school funding in Washington state has gone up in absolute value, as a percent of income it has declined far below the national average:

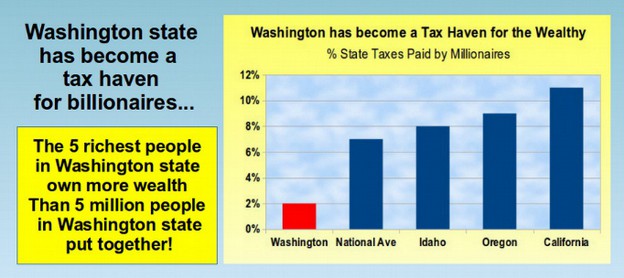

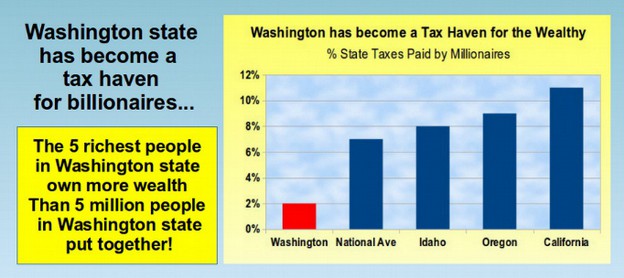

The sharp decline in school funding is closely related to state tax receipt income which has also declined sharply due to the rapid rise in tax exemptions since 1997. These massive tax loopholes for the wealthy cause Washington State to have the most unfair tax system of any State in the nation:

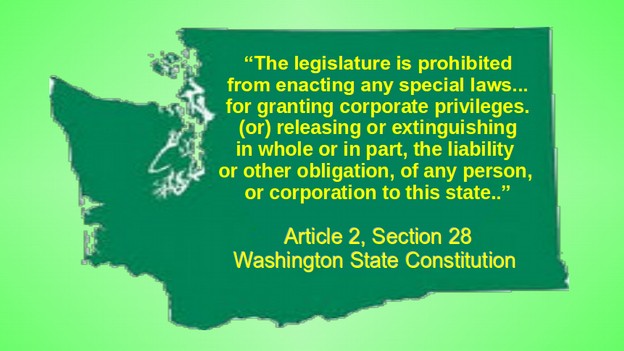

While there are more than 700 tax loopholes for the wealthy, we propose eliminating just the last 300 of them. We believe that it is more important that our kids have safe schools to go to than that billionaires have money to buy bigger boats. This will not harm billionaires as they can deduct their state taxes from their federal taxes. So our proposal is really just a several billion dollar transfer from the federal tax rolls to the state tax rolls.

School Construction Backlog Analysis

Now that we understand the history and underlying cause of the school construction funding shortfall in Washington state, we will take a closer look at how to calculate the total school construction backlog. We mentioned earlier that school construction funding has been under-funded by an average of $2 billion per year for the past 20 years leading to a $40 billion backlog. But it is actually a little more complex than this. There are several problems all of which have gotten worse over time. These include:

#1 Failure to build Permanent School Building – leading to an unhoused student rate of 10% - among the highest in the nation and double the national average.

#2 Classrooms needed for Full Day Kindergarten

#3 Cutting Class Sizes in Grades K through 3 in half

#4 Cutting Class Sizes in Grades 4 through 12 in half

#5 Very Old Unhealthy Schools that do not meet the State Health Code

#6 Very Old Crumbling Schools that do not meet the State Earthquake Safety Code

Over half of the schools in Washington state are more than 50 years old. These are the schools that do not meet the health code or the earthquake code. There are more than 2000 schools in Washington state. So there are more than 1000 schools that are dangerous and need to be replaced. We will now take a look at how much each of these problems will cost to get fixed. The only good news is that when we fix problem #6, we will also fix problem #5.

#1 Failure to build Permanent School Building – Providing Real Permanent Schools for 100,000 Currently Un-housed Students in Washington State would cost $6 Billion Dollars

When billions of dollars in school bonds go down to defeat, school districts are forced to buy temporary portable boxes to use as classrooms. According to a 2008 report by the Washington State Auditor, these portable classrooms cost more than twice as much to heat and maintain as real classrooms.

“The most energy-efficient portables cost about 2.5 times as much to heat, cool and light compared to permanent school buildings.”

Performance Audit Report 1000013 Page 21.

http://app.leg.wa.gov/ReportsToTheLegislature/pdf.ashx?f=ar1000013_fcb4d5ab-253a-468d-b748-299d2f896cc4.pdf

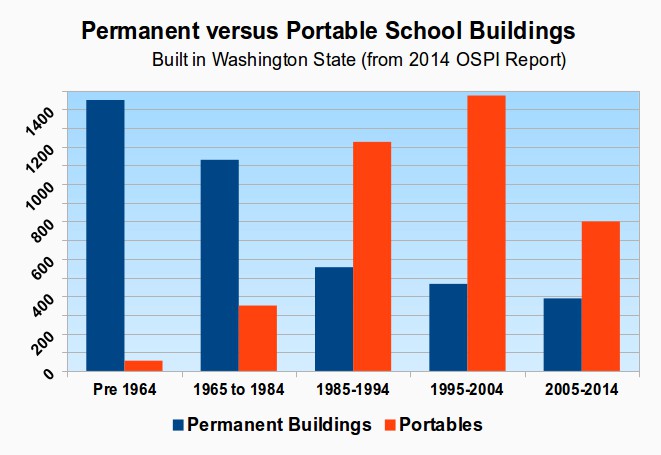

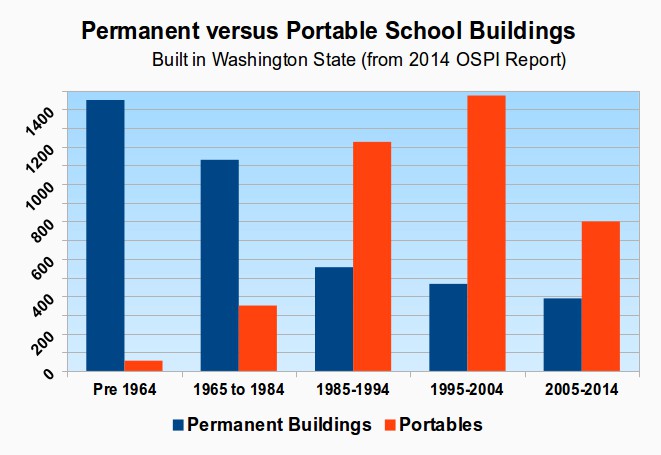

Despite the huge long term cost of portables, the number of permanent school buildings has plunged while the number of portable school buildings has skyrocketed. Fewer permanent classrooms were built in 2005 to 2014 than at any point in the past 30 years. Currently for every permanent new school building in our state, there are two to three temporary particle board boxes added to our schools. These boxes may cost a little less initially. But they cost much more over the long run and are not good learning environments for our students.

These temporary buildings are not only very expensive in the long run, but they also cause health problems in students and teachers. According to the 2008 Auditor report, one in ten of our children – or more than 100,000 children in our State - are attending school in inefficient and unhealthy particle board boxes. This unhoused student rate of 10% is double the national average which is only 5%. As a consequence the average age of permanent school buildings in Washington state is now more than 50 years old!

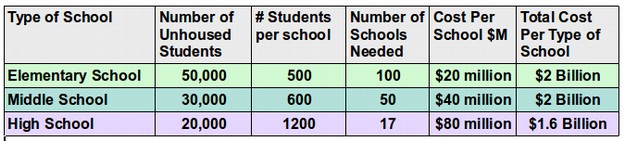

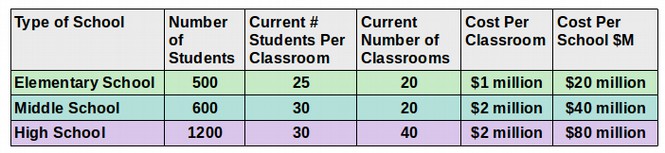

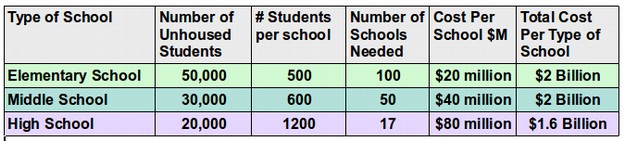

At 500 students per school, we need to build 167 more schools just to address the 100,000 un-housed student problem in our state.

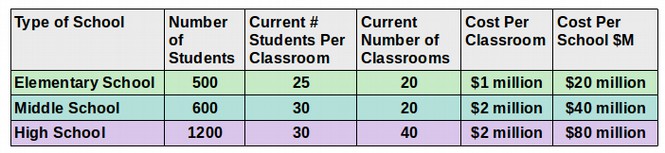

The actual cost of each school is currently about $20 million for an elementary school, $40 million for a middle school and $80 million for a high school. We will assume that one half of the unhoused students attend elementary school, one quarter attend middle school and one quarter attend high school.

The total cost of building 167 additional schools is about $5.6 billion.

#2 Classrooms needed for Full Day Kindergarten… Cost for Full Day Kindergarten Classrooms is $1.6 Billion Dollars

Washington state is moving from half day to full day Kindergarten in the next two years. This is the equivalent of increasing Kindergarten students from 40,000 to 80,000 students. Yet with classrooms already exploding at the seams, there are no classrooms available for these additional 40,000 students. At 500 students per school, it will take building 1600 additional classrooms or 80 additional elementary schools. 80 schools times $20 million per school would require $1.6 billion. True to their pattern of only providing a small fraction of the actual cost, the legislature has proposed providing only $280 million or less than $200,000 per classroom – less than one fifth the actual cost!

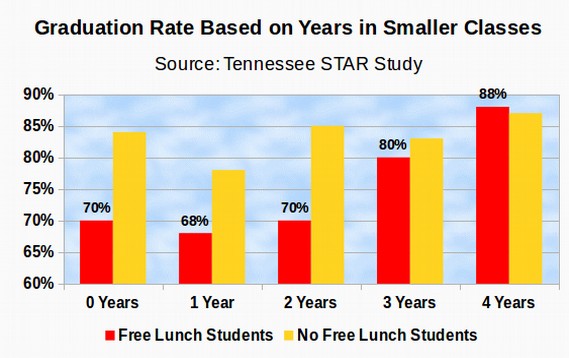

#3 Reducing Class Sizes in Grades K through 3 will cost $4 billion dollars

Another change scheduled for the next three years is reducing class sizes 320,000 students in Grades K through 3 from the current 24 students to 17 students. This will require not only hiring another 5,400 teachers but also building another 5,400 classrooms. At 27 classrooms per new school, this is another 200 elementary schools. Multiple 200 more schools times $20 million per school and the total cost is $4 billion dollars. The capital budget bill, House Bill 115, had $4 billion in funding. However, only one tenth of this or $400 million was for public schools. This was only $200 million per year or $200 per student.

#4 Reducing Class Sizes in Grades 4 through 12 to Support Initiative 1351 will cost $12 Billion Dollars

One of the excuses used to delay Initiative 1351 for four more years was the claim that there are not enough classrooms to support smaller class sizes and it will take years to build all of the classrooms. But while Initiative 1351 was delayed four more years until the 2020 -2021 school year, nothing was done to actually build the classrooms! The average class size in Grades 4 through 12 in Washington state is more than 30 students versus a national average of less than 27 students. Initiative 1351 approved by the voters in 2014 mandates lowering class sizes in Grades 4 through 12 to 25 students. 8 Grades times a grade cohort of 80,000 students is 640,000 students. It would take another 5000 teachers and another 200 schools to lower class sizes down to 25 students for these grades. But middle schools cost $40 million each and high schools cost $80 million each. So we need $4 billion for 100 middle schools and $8 billion for 100 high schools. The total is $12 billion.

Add $12 billion to $4 billion for K3 classrooms plus $1.6 for full day kindergarten plus $5.6 for 100,000 unhoused students comes to $23.2 billion.

#5 Public School Building Health... A Hidden Crisis!

In addition to building new schools, we should also insure the health and safety of existing public schools. Sadly, our state faces a school repair backlog that exceeds more than $10 billion and is certain to be endangering the health of our students. Nearly all buildings are subject to building codes which are regulations intended to insure the safety of occupants. Building codes are revised about every three years. The only buildings exempt from these rules are public schools. In order to keep the construction and repair cost of school buildings down, safety codes for public schools have not been revised in nearly 40 years (since 1971). While an updated school health rule was proposed by the Washington State Board of Health in 2009, the State Legislature has refused to allow the Board of Health to implement the new school health rule. This means that the buildings school children are required to spend their days in are the least safe buildings in our State.

Four main areas of concern include:

1. Air quality and ventilation,

2. Water quality,

3. Protection from pathogens such as mold and mildew.

4. Structural Soundness to Remain Standing in the Event of a Major Earthquake.

Responding to concerns and complaints from parents and teachers, there have been several attempts to address these problem, both legislatively and from the Washington State Department of Health.

In 2005, Representatives Chase, Kenney, Santos and Hasagawa introduced House Bill 2177 requiring the testing of toxic mold in schools. The bill never even got a hearing.

Also in 2005, Senators Jacobsen, Rockefeller, Kohl-Wells, Kline, Franklin and Edie Introduced Senate Bill 5029 which would requiring Safe Drinking Water in Schools There was also a companion bill in the House (HB 1123) on Safe Drinking water in schools sponsored by Representatives Kenney, Dickerson, McIntire, Morrell, Santos, Cody, Upthegrove, Hasegawa, Moeller, Kagi, Ormsby, Chase, Williams, O'Brien, Green, Sullivan, Sells, Wallace, and McDermott. This bill was never brought up for a vote.

Recognizing the lack of support for improving school building safety in the legislature, proponents have also tried to get these safety issues addressed administratively through the Washington State Board of Health by updating the School environmental health (EH) rule, chapter 246-366 WAC (CR 102). Several hearings on the proposed rule update have been held during the past 15 years generally with parents and teachers asking for better air and water quality monitoring while legislators are generally opposed due to concerns about the cost of making schools healthier. These hearings were held by the Board of Health’s Environmental Health (EH) Committee.

During public hearings in 2008, one parent described their child coming home with extreme fatigue, vocabulary loss, headache, bellyaches, and dizziness. Drinking water in her classroom was later found to contain elevated levels of lead. Another parent said her son would complain of terrible stomach pains before dinner every night. She later found out his school had high concentrations of copper in its drinking water.

One parent asked: “I know it will cost money to have safe drinking water in our schools. But how much is a child’s life worth?”

Lead exposure in childhood is known to result in reduced brain size, increased aggression, and a greater likelihood of criminality as a teen and adult. The Department of Health estimates that 30% of schools in Washington have drinking water levels that exceed 20 PPBB for lead. This problem occurs mainly in older crumbling schools that are also structurally unsound. It has been estimated that improving indoor air quality would reduce asthma rates by 20% saving our State more than $2 billion a year in health costs as well as greatly improve academic performance.

In April, 2009, House Bill 2334 was offered by Representatives Dunshee, Williams, Hunt, Ormsby, White, Conway, Hudgins and Chase which would provide $3 billion in school construction and repair bonds. A portion of these funds were intended to cure health problems in our public schools. The Bill eventually died in the Rules Committee and was never brought up for a full vote in the House of Representatives. It is amazing that anyone could vote against a bill essential for protecting the health and safety of school children.

On June 10, 2009, the EH Committee wrote a letter stating that despite making many compromises to reduce the cost, the 2009 legislature included a clause in the final 2009-11 operating budget, passed April 2009 as ESHB 12444, in Section 222 prohibiting the State Department of Health from implementing any new or amended school facility rules without approval of the legislature.

It is known that due to the failure to maintain our public schools, many schools suffer from extreme toxic problems that may cause health problems in sensitive children. Given the rapid rise in asthma, allergies, leukemia, and other severe childhood health concerns, the failure to permit the revision of school health standards, essentially raising them up to the standards already existing for other buildings, is very troubling.

#6 Replacing Very Old Crumbling Schools that do not meet the State Earthquake Safety Code will cost about $40 billion

When we add the $10 billion school health problem to the $23 billion school construction backlog, the total school construction and repair backlog appears to be over $30 billion. However, this does not include the biggest cost of all – rebuilding over half of our dangerous 50 year old schools to prepare for the next major earthquake. This will cost more than $28 billion. However, since it is the older schools that suffer from both health problems and structural problems, the total bill to upgrade every school in our state to the current building and health codes is about $40 billion.

Relocating and Rebuilding Half of All Public Schools to use as Community Emergency Shelters will cost about $28 billion

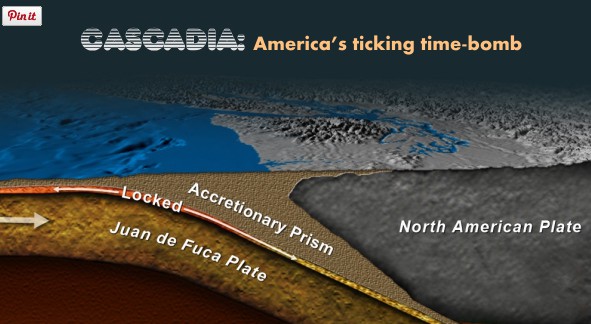

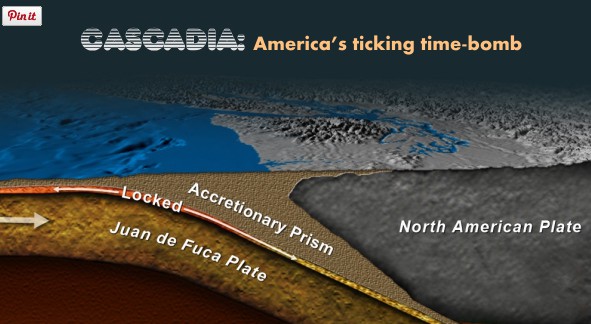

As we noted above, over half of all schools in Washington state are more than 50 years old. Few if any of these buildings are earthquake proof. Yet half of our 60,000 teachers and one million students are required to spend 180 days per year inside of these unsafe crumbling buildings. This is a serious danger because a recent article in the New Yorker explained that Oregon, Washington and British Columbia may soon be hit with the worst natural disaster in history – a Magnitude (M) 9.0 Mega Earthquake due to a rupture of the Cascade Fault out in the Pacific Ocean. http://www.newyorker.com/magazine/2015/07/20/the-really-big-one

The last major quake in Washington State was the 2001 Nisqually quake which measured 6.3 on the Richter scale. http://seattlecentral.edu/faculty/jhull/richter.html

Since an8.0 earthquake is ten times worse than a 7.0 quake and a 9.0 quake is 10 times worse than a 8.0 quake, a 9.0 Mega Quake is 160 times worse than anything we have ever experienced here in Washington state.

The coming Mega Quake could kill thousands of people and cost billions of dollars. Power, food and water supplies could be out for more than one month. Half of all bridges, half of all buildings, half of all schools and half of all homes may be damaged – especially bridges, buildings, schools and homes that are more than 40 years old.

Before dismissing this danger as just one of many threats that will never really happen, here is the pattern of Class 9 Cascadia induced Mega Quakes in the Pacific Northwest for the past 4,500 years. Ever since 2500 BC, our region has suffered a Class 9 mega quake about every 500 years including 2000 BC, 1500 BC, 1000 BC, 500 BC, 0 AD and 500 AD. Major 8.0 Earthquakes have occurred between the Mega Quakes such that the average period between earthquakes was about 200 to 300 years. But then at 500 AD, the pattern changed. 9.0 Mega Quakes have occurred a total of 5 times since 500 – a rate of once every 300 years. Here is the pattern since 500 AD:

As you can see, at more than 315 years of quiet, we are already in the longest period of quiet between Mega Quakes during the past 1500 years. The last time there was this long of a quiet spell was in 200 AD to 500 AD. This last long quiet period between 200 AD and 500 AD was followed by two 9.0 quakes and one 8.0 quake in just 200 years between 500 AD and 700 AD.

These Mega Quakes are all caused by a build up of pressure in the Cascadia Fault. The longer times goes on between faults, the more the pressure builds up and the worse the Mega Quake becomes when it finally does occur. It is therefore likely that the amount of pressure built up currently is similar to the pressure built up in the previous quiet period.

If this were a mathematical probability puzzle, the best guess for the next quake would be sometime between 1900 AD and 2000 AD. So we are already past the most likely time for another earthquake in the 8.0 to 9.0 range. This delay increases the likelihood that the next quake will be a 9.0 quake. From a math probability standpoint, a 9.0 mega quake is likely to occur in the Pacific Northwest in the next 50 to 100 years – and could happen anytime since it is already passed due.

A more interesting question is why the Mega Quake has not happened already. Some have claimed that the Cascadia fault is “stuck” or “locked” on something. Once it releases, there will be a huge mega quake. Every year that goes by simply increases the pressure and force of the quake when it does occur.

What will happen when the Mega Quake does occur?

One FEMA official said that the tsunami associated with this Mega Quake will be more than 100 feet high, move at more than 15 miles per hour and wipe out everything west of Interstate 5. Below is an image of what downtown Seattle will look like when the Viaduct collapses.

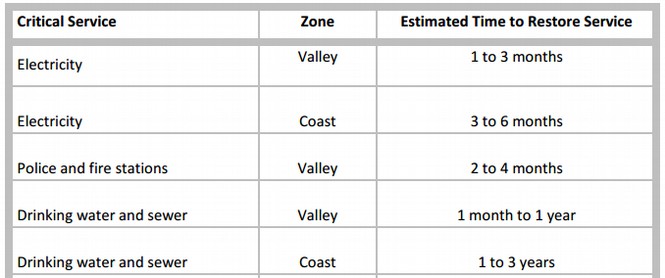

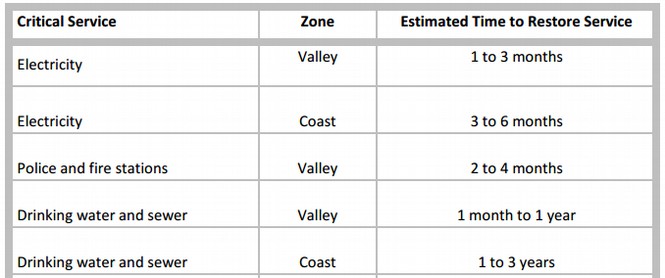

In 2011, Oregon leaders recognized the need to prepare for the eventual likelihood of a major seismic event and called for a statewide plan. The Oregon Resilience Plan was completed in 2013, which can be accessed here: http://www.oregon.gov/OMD/OEM/osspac/docs/Oregon_Resilience_Plan_Final.pdf

In 2011, Oregon leaders recognized the need to prepare for the eventual likelihood of a major seismic event and called for a statewide plan. The Oregon Resilience Plan was completed in 2013, which can be accessed here: http://www.oregon.gov/OMD/OEM/osspac/docs/Oregon_Resilience_Plan_Final.pdf

This plan concluded that water and power will be out for at least one month. Here is a quote from this report: “When, not if, the next great Cascadia subduction zone earthquake strikes the Pacific Northwest, Oregon will face the greatest challenge in its history. Oregon’s buildings, transportation network, utilities, and population are simply not prepared for such an event. Were it to occur today, thousands of Oregonians would die, and economic losses would be at least $32 billion. In their current state, our buildings and lifelines (transportation, energy, telecommunications, and water/wastewater systems) would be damaged so severely that it would take three months to a year to restore full service in the western valleys, more than a year in the hardest-hit coastal areas, and many years in the coastal communities inundated by the tsunami... We need to start preparing now by assessing the vulnerability of our buildings, lifelines, and social systems, and then developing and implementing a sustained program of replacement, retrofit, and redesign to make Oregon resilient to the next great earthquake… This study surveyed public schools and public safety buildings (police and fire stations, hospitals, and emergency operation centers) in Oregon and assessed their potential for collapse in a major earthquake. Almost half of the 2,193 public school buildings examined had a high or very high potential for collapse, as did almost a quarter of the public safety buildings... Over half of the bridges in Oregon are also expected to collapse.”

“It is almost certain that a Cascadia subduction zone earthquake will cause all private and public utilities to fail; this means there will be no municipal water or sewer service, no electricity, no telephone, and no television, radio, or Internet. “

Here is an analysis from the Oregon Earthquake Plan:

The reason that power will be out for so long is that communications can not be restored until power is restored. Food and gas supplies also require power and roads. Banking also requires power. But power cannot be restored until roads and bridges are restored. But how can we restore roads and bridges without power?

The answer is that rescue and repair people would have to start at Spokane and start repairing power and roads and bridges working their way westward to the Puget Sound region. Crazy as this sounds, this is actually the plan.

Schools are among the most heavily used public buildings and one of a few classes of buildings whose occupants’ presence is compulsory. In 2010, the Western States Seismic Policy Council (WSSPC) adopted a policy recommendation that states, “Children have the right to be safe in school buildings during earthquakes” (WSSPC, 2010).

OSPI says there are 4000 permanent school buildings and about 4000 portable buildings. Since half of these school buildings are at risk of collapsing, half of our one million students or 500,000 students are at risk of being killed or injured. Yet, the Washington legislature has done almost nothing to protect our public schools.

Using Public Schools as Emergency Shelters

Shelter including a place with food and water will be essential to insure the survival of those whose homes are destroyed by the mega quake. If half of the homes and apartments are destroyed, this will require emergency shelters in every community. The most common buildings on the lists of community emergency shelters are public schools capable of holding a large number of occupants. However, if half of the school buildings are also destroyed, many communities will be left without any emergency shelters just when these shelters are most needed.

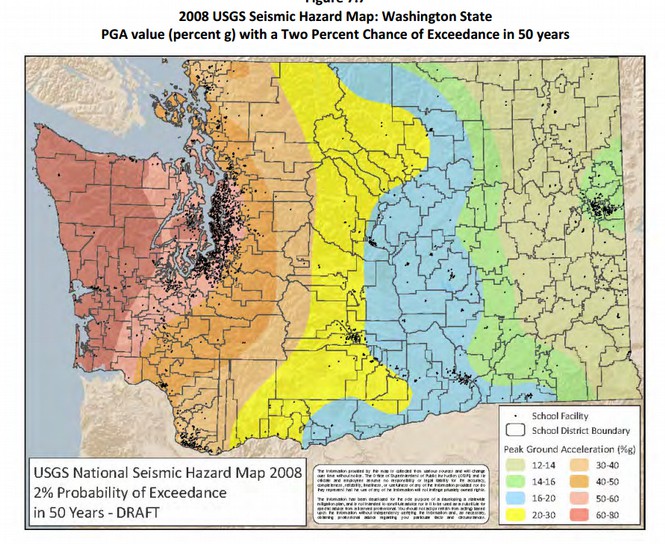

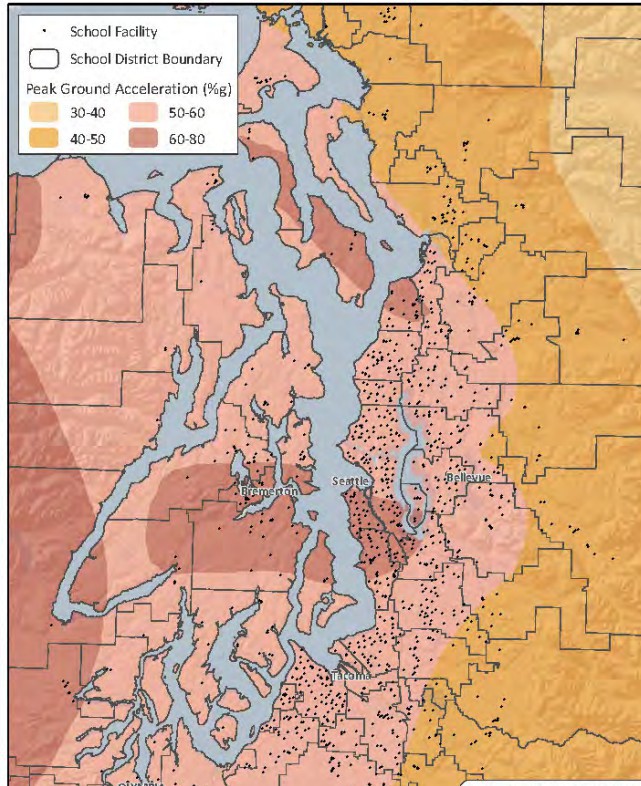

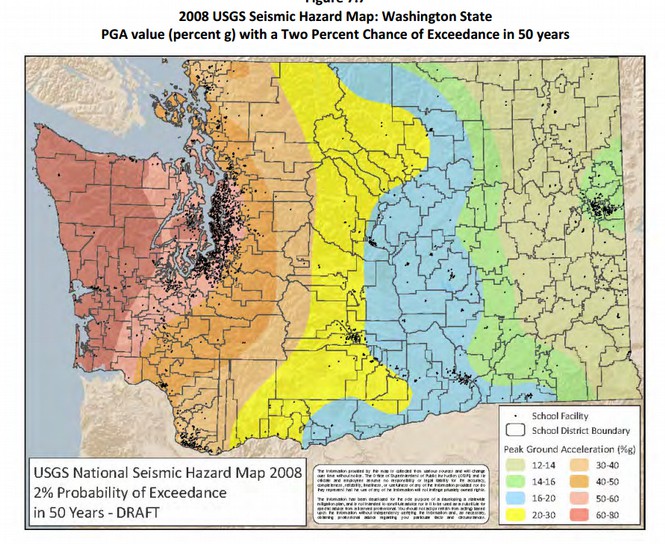

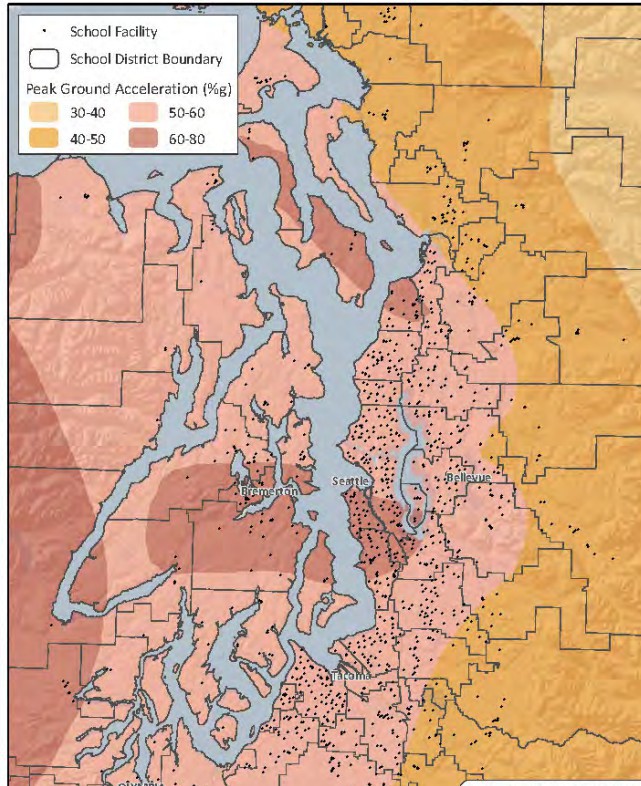

In addition, if schools collapse when students are in them, the death toll and injuries resulting from even a single school building collapse could be staggering. Here is a map of the location of schools with the areas at greatest risk shown from west to eat:

Here is a more detailed map of the schools are greatest risk in the Puget Sound region:

What would it cost to relocate and replace schools for 500,000 students?

This is actually relatively easy to calculate. We have previously determined that it would cost about $5.6 billion to build 167 schools for 100,000 unhoused students (replacing more than 500 portable classrooms). Therefore, it will cost about $28 billion to relocate and rebuild about 1,000 schools for 500,000 students. But since about $10 billion these schools are covered in the $22 billion school construction projects to reduce class sizes, the actual amount needed is about $18 billion. The entire building program would mean that Washington state would have at least 3,000 modern earthquake proof schools that could be used as Community Emergency Shelters in the aftermath of a Class 9 earthquake. All that would be needed besides these 2,000 buildings would be stockpiles of food and water for the entire community to last for 30 days until outside transportation and communications could be restored.

Adding it all up... The total cost for these 1,650 schools is $51.2 Billion Dollars

Real Schools for 100,000 Currently Unhoused Students........ $5.6 Billion Dollars

Full Day Kindergarten Classrooms...........................................$1.6 Billion Dollars

Reduce Class Sizes in Grades K through 3............……............$4 Billion Dollars

Reduce Class Sizes to Support Initiative 1351......……............$12 Billion Dollars

Replace Unsafe Crumbling Schools for 500,000 students…... $18 Billion Dollars

Total School Construction Needs …....................................$41.2 Billion Dollars

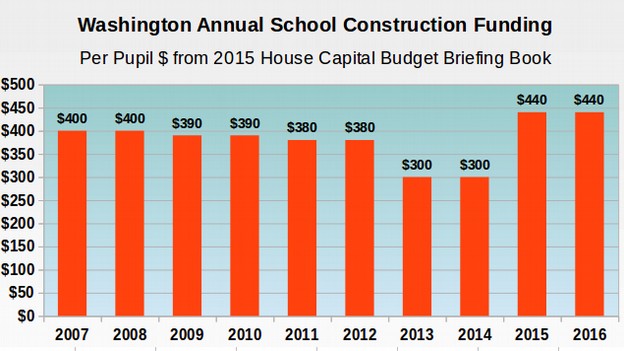

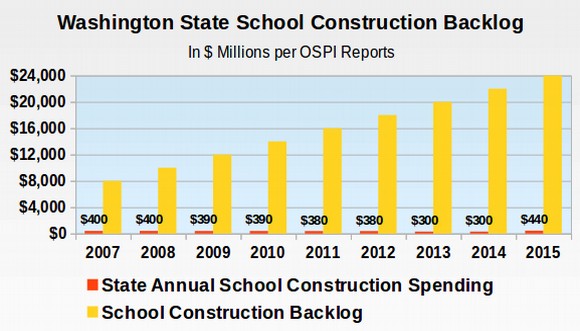

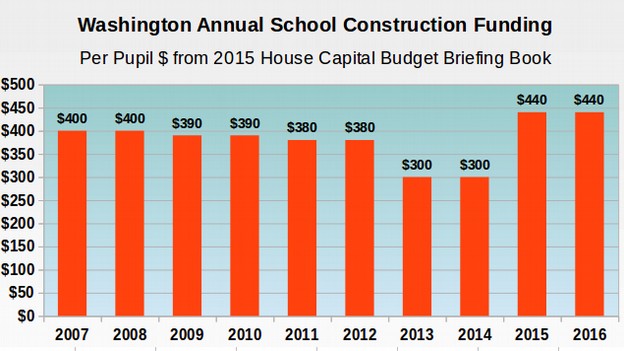

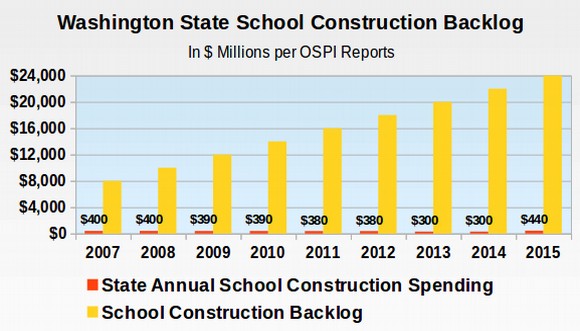

Total School Construction budget for the next two years (2016-2017)is only $440 million per year – only one percent of what is actually needed!

2015 Legislature Continues to Ignore the Actual Cost of Building Schools

In the school construction section of the 2015 legislature's July 27threport to the court, theyfalsely claims that the 2015 budget “funds full implementation of all-day kindergarten in the 2016-17 school year and “makes steady and substantial progress toward funding for K-3 class size reduction in the 2015-16 and 2016-17 school years.”

In fact, Senate Bill 6080 which supposedly provides the funding to built the classrooms needed to lower class sizes in Grades K-3 only provides $200 million during the next two years. Even this $200 million is an illusion because what the legislature really did was CUT $200 million from the previous biennium budget and then RESTORE $200 billion in this biennium budget and then claim they increased funding by $200 million when they only restored their previous budget cut. This is the kind of “smoke and mirrors” that the legislature is trying to put past the voters and the Supreme Court.

To be more precise, from the 2011 biennium to 2013 biennium, school construction funding fell from $800 million per biennium to $600 million per biennium. Thus, $200 million was cut from the previous biennium's school construction budget. In the 2015 biennium, the legislature merely added back the $200 million they cut two years ago. Now they have the audacity to call it new funding! In the current two year period, they alloted $600 million for school construction and put the other $200 million in a special account for K3 class size reduction. This makes it look like the legislature did something when they really did not increase funding at all over their $400 million per year level of four years ago – a level that only funded 10% of actual school construction.

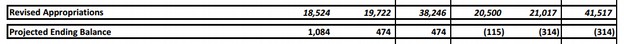

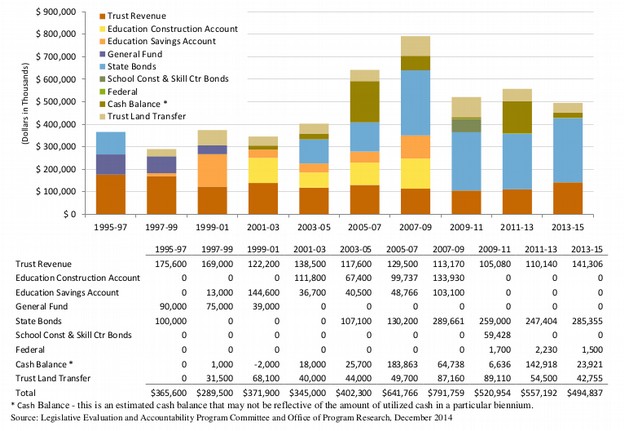

Here is a chart of Washington School Construction funding during the past 10 years.

http://leg.wa.gov/House/Committees/CB/Documents/2015/CB_BriefingBook.pdf

The $440 million per year for the 2015 and 2016 school years is much less than the $400 million for the 2007 and 2008 school years due to inflation. But more important, $400 million per year in 2007 and 2008 were only one tenth of what was actually needed due to the prior years school construction funding shortfalls. As we have shown, $440 million per year is only a tiny fraction of what is actually needed.

Sadly, the rules to get state matching funds make it almost impossible for school districts to qualify. For example, even though the Seattle School District needs hundreds of millions of dollars of new schools, they only qualify for a “Two Percent” State Match. As the following graph shows, the grossly inaccurate school construction match formula means that in recent years, the entire amount of state matching funds has not even been used:

Subtracting the unused Cash Balance, the amount spent on school construction in the 2011 to 2013 biennium and the 2013 to 2015 biennium was less than $400 million.

Does the State Constitution Require the Legislature to Build Schools?

The legislature's response to this huge backlog? Many in the legislature have made the ridiculous claim that they have no responsibility to build schools – only to operate them! According to the legislature's 2015 report to the court, school construction is not their responsibility. Instead, each school district is responsible for building their own schools. Here is a quote from their report to the court: “Part IV: School Construction A. Capital Budget Second Engrossed House Bill 1115 (2015) Funding for school construction is appropriated in the state’s capital budget bill and is outside the state’s statutory program of basic education. The capital budget provides $611 million in state appropriations for the School Construction Assistance Program, under which the state allocates matching funds to school districts. In addition, as described below, the capital budget provides an additional $200 million for grants targeted to K- 3 class size reduction and all-day kindergarten.”

Here is their interpretation of the state constitution found in Section 101 of Senate Bill 6080 passed by the legislature in July 2015: “Article VII, section 2 of the state Constitution authorizes school districts to collect capital levies to support the construction, remodeling, or modernization of school facilities. In addition, Article VIII, section 6 of the state Constitution authorizes school districts to incur debt up to eleven and one-half percent of the total assessed value of taxable property for school construction and Article VII, section 2 of the state Constitution authorizes school districts to pay for this debt by issuing general bonds.”

It is absurd to contend that the drafters of our state constitution intended for the state to provide for a uniform system of public schools including paying for all of the teachers – but then not be responsible for paying for the classrooms required by those teachers to actually teach in. It is even more absurd to claim that the drafters of our constitution were aware of the drawbacks of over-reliance on local levies in terms of creating rich schools and poor schools – but then not be aware that over-reliance on local bonds would lead to exactly the same two-tier system of wealthy school districts that could pass local bonds and poor school districts that could not pass local bonds.

Our Supreme Court also thinks that the State Constitution requires the legislature to pay the full cost of school construction. In its January 9 2014 order the Court wrote that “the State must account for the actual cost to schools by providing these components (the cost of classrooms associated with class size reductions through additional capital expenditures).” http://www.courts.wa.gov/content/publicUpload/Supreme%20Court%20News/20140109_843627_McClearyOrder.pdf

Conclusion… A Simple Solution to the School Funding Problem

Combine $4 billion per year in school construction costs with $8 billion per year in school operating costs and it is plain that the state legislature is underestimating the cost of fully funding school operation and construction by as much as $12 billion per year. Instead of funding schools, our current leaders give away billions of dollars per year in tax breaks to wealthy multinational corporations at the same time that they tell us there is not enough money to hire the teachers or build schools. As a consequence, our children are forced to endure some of the lowest funded and most over-crowded schools in the nation.

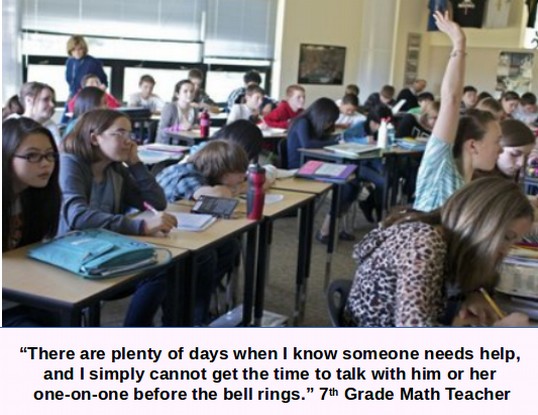

Total annual tax breaks are currently $36 billion per year. If we simply eliminate all 300 tax breaks since 1996, we would have an additional $16 billion per year. $4 billion per year would allow us to complete the entire $40 billion school construction project in the next 10 years.

At 30,000 jobs per billion dollars, $16 billion per year devoted to school construction and hiring teachers would also allow us to create 480,000 school construction and teaching jobs.

The good news is that a State Public Bank could leverage these funds so we could build more schools sooner and then pay ourselves back over time. As the bank builds its assets, just like the Bank of North Dakota, it will no longer need additional capital. Instead, the bank will be able to pay the tax payers income allowing us to reduce taxes and eliminate debt to private Wall Street banks just as they have done in North Dakota.

The most shocking difference between the two States is the difference in outstanding long term debt on school construction projects. In North Dakota, school construction projects are pay as you go, meaning total capital debt is only $347 million. But in Washington State, the total school debt is $9.54 billion. This is 36 times higher than North Dakota. Even adjusting for the fact that Washington State has 10 times more students, the capital debt per student is 3.6 times higher in Washington State than in North Dakota.

(See US Census Bureau Public Education Finances Table 1 Column 10 and Table 10 2013 report is the latest report published June 2015) http://www2.census.gov/govs/school/13f33pub.pdf

Clearly having their own public bank in North Dakota has resulted in much better capital funding and much lower capital costs for public school students in North Dakota. Meanwhile, Washington State schools (and homeowners) are buried under a rising mountain of debt. Sadly, because of a massive school construction backlog, the long term debt situation is going to get much worse.

Still, the most important reason to act nowis this: if we do not immediately begin replacing our older crumbling schools, when the next Mega earthquake strikes, it will collapse as many as half of all schools – causing injury or death to 500,000 innocent children as well as about 30,000 teachers.

Are tax breaks for the wealthy really more important than the lives of half a million students? It is time to start requiring billionaires to pay their fair share of state taxes so we can finally address the school construction backlog here in Washington state. This is why I am running for Superintendent - to make this happen. If you agree, then please join our campaign team, tell your friends and organize an informational session in your community. Together, we can build 1,000 urgently needed schools here in Washington state and provide every student with a safe and health school.

As always, we look forward to your questions and comments.

Regards,

David Spring M. Ed.

Candidate for Superintendent of Public Instruction

david (at) springforschools (dot) org

In this article, we will explain how the Washington legislature is so corrupt that they have risked the health and safety of half a million students in order to keep the gravy train of billions in tax breaks going for wealthy multinational corporations. The shocking fact is that half of Washington's 2,000 schools are so old and run down that they do not meet either the health codes or the earthquake codes. That's right. The Washington legislature is willing to kill and injury thousands of our kids to protect billions in tax breaks for Microsoft and Boeing.

Why are the health codes important?

In the past few months, we have read about thousands of children in Flint Michigan who were essentially poisoned by a corrupt government that refused to provide those kids with a safe source of drinking water. Sadly, the Washington State legislature has also refused to come up with the funds needed to provide safe drinking water at schools here in Washington state. And it is not just the water. Many older schools suffer with major mold problems. Instead of coming up with billions of dollars needed to provide students with healthy schools, the corrupt Washington legislature has "exempted" our schools from the health codes!

Specifically, after a shocking report on drinking water and other health hazards in our public schools by the State Health Department, the 2009 legislature responded to this health crisis by including a clause in the final 2009-11 operating budget, passed April 24 2009 as ESHB 1244, in Section 222 prohibiting the State Department of Health from implementing any new or amended school facility health safety rules without approval of the legislature.

http://sboh.wa.gov/OurWork/Rulemaking/SchoolsEnvironmentalHealth

Who voted for this draconian bill prohibiting the State Department of Health from adopting new safety rules even after the Department of Health sent a specific letter about the health problems of our public schools? Representative Larry Seaquist - one of the candidates now running for Superintendent of Public Instruction. Who was the most vocal proponent of protecting the health of our students back in 2009? That was me. I wrote numerous reports on the health problems facing our public schools summarizing the finding from the Washington State Department of Health public hearings on school health.

Half of our schools have water damage (which leads to mold and other toxins). Half have poor air quality. Thirty percent of our schools are estimated to have excessive lead in the water (which causes brain damage in children). Most of these problems are related to older schools. Half of our schools are more than 50 years old.

One mother, Odele La Lemond testified about how her bright, engaged child, deteriorated before her eyes. At one point, her daughter could not remember where her bedroom was after returning from a trip. Other symptoms included extreme fatigue, vocabulary loss, headaches, bellyaches, dizziness, and loss of balance. Drinking water in her classroom was found to contain elevated levels of lead.

One parent asked: “I know it will cost money to have safe drinking water in our schools. But how much is a child’s life worth?”

Here are some shocking facts about the lack of health standards in our schools. The original school health rule "suggested" that schools be inspected by the county health department periodically. Unfortunately, most counties simply ignore the old rule. Thus, in many counties, there is absolutely no one checking on schools to make sure they are safe.

The new proposed new school health rule would require that each county health department periodically inspect schools to make sure they are safe - just as health department inspectors check on restaurants to make sure they are safe. Legislators, including Seaquist and Reykdal, have blocked the new rule from being implemented by including a special clause in the state budget every year which prohibits the State Department of Health from implementing the new rule.

Why prohibit schools from being inspected? Because every legislator in Olympia knows that our schools do not meet health standards. But they do not want an inspector documenting these problems with mold and unsafe drinking water because the public would then become outraged - just as they are outraged in Flint Michigan - and then the legislature would be forced to spend billions of dollars replacing old crumbling and unhealthy schools.

As Superintendent, I will immediately implement the recommended rules of the Washington State Department of Health. Our kids have a constitutional right to attend a safe and health school. The failure of the Washington State legislature to provide funding for safe drinking water and air quality in our schools is one more example of why I have concluded that our current state legislature may be one of the most corrupt legislatures in the nation.

Why are the earthquake codes important?

On April 16 2016, a Magnitude 7.3 quake struck Japan killing dozens and injuring thousands. A few hours later, a Magnitude 7.8 quake struck Ecuador killing hundreds and injuring thousands more. Thousands of families are now camping in the streets without water or homes. As bad as these quakes were, the fact is that Washington state is at extremely high risk of a Magnitude 9 earthquake sometime in the next few years.

Understanding the Richter scale

The Richter scale is a scale based on multiples of ten. Thus a Magnitude 5 quake is ten times worse than a Magnitude 4 quake and a Magnitude 6 quake is 100 times worse than a Magnitude 4 quake. This makes the Japan 7.3 quake about 1000 times worse than a Magnitude 4 quake and it makes the the Ecuador quake about 10,000 times worse than a Magnitude 4 quake. But a Magnitude 9 quake, commonly called a Super Quake, will be more than 10 times worse than the quake that struck Ecuador two days ago and 10,000 times worse than a Magnitude 4 quake. Here is a visual graph of the Richter scale with a Magnitude 4 quake set for 1.

The last time Washington suffered a Magnitude 9 quake was just over 300 years ago in January 1700. Magnitude 9 Mega Quakes have occurred a total of 5 times since 500 – a rate of once every 300 years. Research into the pattern of these Super Quakes shows they strike Washington about every 300 years - meaning we are already overdue for another Magnitude 9 earthquake. Here is the pattern since 500 AD.

As you can see, at more than 316 years of quiet, we are already in the longest period of quiet between Mega Quakes during the past 1500 years. The last time there was this long of a quiet spell was in 200 AD to 500 AD. This last long quiet period between 200 AD and 500 AD was followed by two 9.0 quakes and one 8.0 quake in just 200 years between 500 AD and 700 AD.

Because half of our 2,000 schools are more than 50 years old and do not meet the earthquake codes, about 1,000 schools will be destroyed in a Magnitude 9 Super Quake. If this happens on a school day, as many as 500,000 students could be killed or injured. The clock is ticking. Every day this problem is not addressed, the danger to our kids grows even higher. This is without a doubt the gravest safety risk to children in the history of our nation. What is the Washington legislature doing about it? Absolutely nothing!

While both Oregon and British Columbia are at least trying to improve the safety of their schools, the Washington state legislature has done absolutely nothing to improve the safety of our schools. Instead, they claimed that they do not have the $30 billion it would take to replace 1,000 schools. Yet in just three days, they were able to fund $9 billion to give Boeing. Even worse, the legislature actually gives away $30 billion per year in tax breaks. Suspend these illegal tax breaks for even one year and we could have 1,000 safe schools the very next year. Hopefully, these facts will help you understand why I claim that the Washington state legislature is the most corrupt legislature in the nation.

We will provide more analysis of this Super Quake danger to students in Washington state in a moment. But first we will provide a summary of the shocking lack of funding for school construction in Washington state in the past 20 years and how this lack of funding has led to a $40 billion school construction crisis.

Washington State $40 Billion School Construction Crisis

While a great deal has been written about the failure of the Washington State legislature to fully fund the operation of public schools, fully funding school construction and repair is by far the greatest need being ignored by our state legislature.

Washington State is near the bottom of the nation in school operation funding as a percent of state income - which is why class sizes in Washington state are near the highest in the nation. It would take about $8 billion per year in additional state revenue to restore school funding and cut class sizes in half.

However, the shortfall in school construction and repair spending is now more than $40 billion – almost 5 times greater than the shortfall in school operation spending. As a consequence, Washington state has one of the highest rates of “unhoused students” in the nation. Restoring school operation and construction funding must both be done at the same time. It does no good to hire 40,000 additional teachers to cut class sizes in half unless we also build 40,000 additional classrooms for those teachers and their students to learn in. Sadly, the Washington State legislature has underestimated school construction and repair costs by more than $2 billion per year – for more than 20 years – leading to a school construction and repair backlog of more than $40 billion. Our plan is to invest $4 billion per year over a 10 year period – and pay for the increase in school construction and operation funding by repealing a tax break now used by billionaires to avoid paying their fair share of state taxes.

Why the State Legislature – Not Local Home Owners – is Responsible for Building and Repairing Public

Some in the State legislature claim that it is up to local homeowners to pass bonds to build public schools – that the State legislature is only responsible for hiring teachers. However, our Supreme Court has repeatedly stated that the legislature must provide 100% of the actual cost to build, repair and operate our public schools.

Decades of Decline in School Construction Funding

For more than two decades, our legislature has refused to pay more than a small fraction of the actual cost of building and repairing schools. Whereas our State legislature historically provided more than 66% of the actual construction costs of public schools, State funding for school construction has fallen to below 10% of actual costs during the past 20 years.

We will need to hire 40,000 additional teachers to cut class sizes in half. Obviously, this will require building 40,000 additional classrooms. Sadly, not only has our legislature failed to provide adequate funds for operating schools, but they have also failed to supply funds for the repair and building of schools.

Instead, the Washington state legislature has shifted the responsibility for building and repairing schools onto the backs of local homeowners (just as they have illegally shifted the cost of operating schools onto the backs of local homeowners by raising the levy lid). This failure by the state legislature to fund school construction has led to more than 11 billion dollars in school bond failures during the past 11 years. The decline in State Matching funds has resulted in a transfer of this funding burden from the State to local home owners via an increasing dependence on local school construction bonds. Like with operating costs, the State’s failure to help fund school construction has led to a dramatic increase in local school bond and levy costs which in turn have led to a rapid rise in local property taxes.

This unfair property tax burden increase on middle class homeowners is as high as $2,000 additional dollars per year on the average home in King County. For example, in 2014, residents in King County paid on average $4,507 annually in property tax. This is more than twice what we paid in property taxes in 1996. This dramatic rise in property taxes can best be seen in the chart of total King County Taxes since 1996. The total property tax collected has more than tripled even as funding for schools and other services have been slashed:

Source: 2015-2016 King County Issue Paper General Fund Financial Situation

http://kingcounty.gov/exec/PSB/Budget/2015-2016.aspx/2015-16Issue_Paper-GenFundSit.pdf

By rolling back these property taxes to what they were in 1996, the average homeowner in King County would save more than $2,000 per year.

Washington Supreme Court Orders the State Legislature to Comply with our State Constitution

In January 2012, the Washington State Supreme Court ruled that the State legislature had failed to adequately fund our public schools. The Supreme Court gave the State legislature 5 years – until September 2017 - to comply with our State Constitution. Sadly, our State legislature ignored this Supreme Court order during the 2012, 2013 and 2014 legislative sessions. In September 2014, the Supreme Court found the State Legislature in Contempt of Court for failing to make steady progress towards fully funding public schools. In 2015, the State legislature again failed to make steady progress towards fully funding public schools. Therefore in August, 2015, the Washington Supreme Court sanctioned the State legislature by assessing fines for failure to fully fund our public schools. Despite these sanctions, the legislature continues to ignore their constitutional obligation to fully fund school construction, repair and operation.

Follow the Money!

The legislature claims that they do not have the money to fund our schools. But everyone in Olympia knows where the money went that used to be invested in our public schools. In the 1980s, our State was 11th in the nation in school funding. However, since then, as the following charts show, tax breaks for billionaires and wealthy multinational corporations have skyrocketed to more than $30 billion per year – at the same time that state revenue and school operation funding have plunged to near the lowest in the nation. We propose rolling back these tax breaks for the rich by 20% in order to restore school operation and construction funding.

Here is the increase in tax breaks during the past 15 years:

You can see that tax breaks for the wealthy are about four times greater than school funding for our state's one million school children. Since 2000, tax exemptions have increased by $16 billion from $20 to $36 billion while school funding has increased by $4 billion from $5 to $9 billion. We propose reducing tax exemptions by $16 billion per year - rolling them back to what they were in 1996 – so that we can increase school construction and operation funding by $12 billion per year.

While school funding in Washington state has gone up in absolute value, as a percent of income it has declined far below the national average:

The sharp decline in school funding is closely related to state tax receipt income which has also declined sharply due to the rapid rise in tax exemptions since 1997. These massive tax loopholes for the wealthy cause Washington State to have the most unfair tax system of any State in the nation:

While there are more than 700 tax loopholes for the wealthy, we propose eliminating just the last 300 of them. We believe that it is more important that our kids have safe schools to go to than that billionaires have money to buy bigger boats. This will not harm billionaires as they can deduct their state taxes from their federal taxes. So our proposal is really just a several billion dollar transfer from the federal tax rolls to the state tax rolls.

School Construction Backlog Analysis

Now that we understand the history and underlying cause of the school construction funding shortfall in Washington state, we will take a closer look at how to calculate the total school construction backlog. We mentioned earlier that school construction funding has been under-funded by an average of $2 billion per year for the past 20 years leading to a $40 billion backlog. But it is actually a little more complex than this. There are several problems all of which have gotten worse over time. These include:

#1 Failure to build Permanent School Building – leading to an unhoused student rate of 10% - among the highest in the nation and double the national average.

#2 Classrooms needed for Full Day Kindergarten

#3 Cutting Class Sizes in Grades K through 3 in half

#4 Cutting Class Sizes in Grades 4 through 12 in half

#5 Very Old Unhealthy Schools that do not meet the State Health Code

#6 Very Old Crumbling Schools that do not meet the State Earthquake Safety Code

Over half of the schools in Washington state are more than 50 years old. These are the schools that do not meet the health code or the earthquake code. There are more than 2000 schools in Washington state. So there are more than 1000 schools that are dangerous and need to be replaced. We will now take a look at how much each of these problems will cost to get fixed. The only good news is that when we fix problem #6, we will also fix problem #5.

#1 Failure to build Permanent School Building – Providing Real Permanent Schools for 100,000 Currently Un-housed Students in Washington State would cost $6 Billion Dollars

When billions of dollars in school bonds go down to defeat, school districts are forced to buy temporary portable boxes to use as classrooms. According to a 2008 report by the Washington State Auditor, these portable classrooms cost more than twice as much to heat and maintain as real classrooms.

“The most energy-efficient portables cost about 2.5 times as much to heat, cool and light compared to permanent school buildings.”

Performance Audit Report 1000013 Page 21.

http://app.leg.wa.gov/ReportsToTheLegislature/pdf.ashx?f=ar1000013_fcb4d5ab-253a-468d-b748-299d2f896cc4.pdf

Despite the huge long term cost of portables, the number of permanent school buildings has plunged while the number of portable school buildings has skyrocketed. Fewer permanent classrooms were built in 2005 to 2014 than at any point in the past 30 years. Currently for every permanent new school building in our state, there are two to three temporary particle board boxes added to our schools. These boxes may cost a little less initially. But they cost much more over the long run and are not good learning environments for our students.

These temporary buildings are not only very expensive in the long run, but they also cause health problems in students and teachers. According to the 2008 Auditor report, one in ten of our children – or more than 100,000 children in our State - are attending school in inefficient and unhealthy particle board boxes. This unhoused student rate of 10% is double the national average which is only 5%. As a consequence the average age of permanent school buildings in Washington state is now more than 50 years old!

At 500 students per school, we need to build 167 more schools just to address the 100,000 un-housed student problem in our state.

The actual cost of each school is currently about $20 million for an elementary school, $40 million for a middle school and $80 million for a high school. We will assume that one half of the unhoused students attend elementary school, one quarter attend middle school and one quarter attend high school.

The total cost of building 167 additional schools is about $5.6 billion.

#2 Classrooms needed for Full Day Kindergarten… Cost for Full Day Kindergarten Classrooms is $1.6 Billion Dollars

Washington state is moving from half day to full day Kindergarten in the next two years. This is the equivalent of increasing Kindergarten students from 40,000 to 80,000 students. Yet with classrooms already exploding at the seams, there are no classrooms available for these additional 40,000 students. At 500 students per school, it will take building 1600 additional classrooms or 80 additional elementary schools. 80 schools times $20 million per school would require $1.6 billion. True to their pattern of only providing a small fraction of the actual cost, the legislature has proposed providing only $280 million or less than $200,000 per classroom – less than one fifth the actual cost!

#3 Reducing Class Sizes in Grades K through 3 will cost $4 billion dollars

Another change scheduled for the next three years is reducing class sizes 320,000 students in Grades K through 3 from the current 24 students to 17 students. This will require not only hiring another 5,400 teachers but also building another 5,400 classrooms. At 27 classrooms per new school, this is another 200 elementary schools. Multiple 200 more schools times $20 million per school and the total cost is $4 billion dollars. The capital budget bill, House Bill 115, had $4 billion in funding. However, only one tenth of this or $400 million was for public schools. This was only $200 million per year or $200 per student.

#4 Reducing Class Sizes in Grades 4 through 12 to Support Initiative 1351 will cost $12 Billion Dollars

One of the excuses used to delay Initiative 1351 for four more years was the claim that there are not enough classrooms to support smaller class sizes and it will take years to build all of the classrooms. But while Initiative 1351 was delayed four more years until the 2020 -2021 school year, nothing was done to actually build the classrooms! The average class size in Grades 4 through 12 in Washington state is more than 30 students versus a national average of less than 27 students. Initiative 1351 approved by the voters in 2014 mandates lowering class sizes in Grades 4 through 12 to 25 students. 8 Grades times a grade cohort of 80,000 students is 640,000 students. It would take another 5000 teachers and another 200 schools to lower class sizes down to 25 students for these grades. But middle schools cost $40 million each and high schools cost $80 million each. So we need $4 billion for 100 middle schools and $8 billion for 100 high schools. The total is $12 billion.

Add $12 billion to $4 billion for K3 classrooms plus $1.6 for full day kindergarten plus $5.6 for 100,000 unhoused students comes to $23.2 billion.

#5 Public School Building Health... A Hidden Crisis!

In addition to building new schools, we should also insure the health and safety of existing public schools. Sadly, our state faces a school repair backlog that exceeds more than $10 billion and is certain to be endangering the health of our students. Nearly all buildings are subject to building codes which are regulations intended to insure the safety of occupants. Building codes are revised about every three years. The only buildings exempt from these rules are public schools. In order to keep the construction and repair cost of school buildings down, safety codes for public schools have not been revised in nearly 40 years (since 1971). While an updated school health rule was proposed by the Washington State Board of Health in 2009, the State Legislature has refused to allow the Board of Health to implement the new school health rule. This means that the buildings school children are required to spend their days in are the least safe buildings in our State.

Four main areas of concern include:

1. Air quality and ventilation,

2. Water quality,

3. Protection from pathogens such as mold and mildew.

4. Structural Soundness to Remain Standing in the Event of a Major Earthquake.

Responding to concerns and complaints from parents and teachers, there have been several attempts to address these problem, both legislatively and from the Washington State Department of Health.

In 2005, Representatives Chase, Kenney, Santos and Hasagawa introduced House Bill 2177 requiring the testing of toxic mold in schools. The bill never even got a hearing.

Also in 2005, Senators Jacobsen, Rockefeller, Kohl-Wells, Kline, Franklin and Edie Introduced Senate Bill 5029 which would requiring Safe Drinking Water in Schools There was also a companion bill in the House (HB 1123) on Safe Drinking water in schools sponsored by Representatives Kenney, Dickerson, McIntire, Morrell, Santos, Cody, Upthegrove, Hasegawa, Moeller, Kagi, Ormsby, Chase, Williams, O'Brien, Green, Sullivan, Sells, Wallace, and McDermott. This bill was never brought up for a vote.

Recognizing the lack of support for improving school building safety in the legislature, proponents have also tried to get these safety issues addressed administratively through the Washington State Board of Health by updating the School environmental health (EH) rule, chapter 246-366 WAC (CR 102). Several hearings on the proposed rule update have been held during the past 15 years generally with parents and teachers asking for better air and water quality monitoring while legislators are generally opposed due to concerns about the cost of making schools healthier. These hearings were held by the Board of Health’s Environmental Health (EH) Committee.

During public hearings in 2008, one parent described their child coming home with extreme fatigue, vocabulary loss, headache, bellyaches, and dizziness. Drinking water in her classroom was later found to contain elevated levels of lead. Another parent said her son would complain of terrible stomach pains before dinner every night. She later found out his school had high concentrations of copper in its drinking water.

One parent asked: “I know it will cost money to have safe drinking water in our schools. But how much is a child’s life worth?”

Lead exposure in childhood is known to result in reduced brain size, increased aggression, and a greater likelihood of criminality as a teen and adult. The Department of Health estimates that 30% of schools in Washington have drinking water levels that exceed 20 PPBB for lead. This problem occurs mainly in older crumbling schools that are also structurally unsound. It has been estimated that improving indoor air quality would reduce asthma rates by 20% saving our State more than $2 billion a year in health costs as well as greatly improve academic performance.

In April, 2009, House Bill 2334 was offered by Representatives Dunshee, Williams, Hunt, Ormsby, White, Conway, Hudgins and Chase which would provide $3 billion in school construction and repair bonds. A portion of these funds were intended to cure health problems in our public schools. The Bill eventually died in the Rules Committee and was never brought up for a full vote in the House of Representatives. It is amazing that anyone could vote against a bill essential for protecting the health and safety of school children.

On June 10, 2009, the EH Committee wrote a letter stating that despite making many compromises to reduce the cost, the 2009 legislature included a clause in the final 2009-11 operating budget, passed April 2009 as ESHB 12444, in Section 222 prohibiting the State Department of Health from implementing any new or amended school facility rules without approval of the legislature.

It is known that due to the failure to maintain our public schools, many schools suffer from extreme toxic problems that may cause health problems in sensitive children. Given the rapid rise in asthma, allergies, leukemia, and other severe childhood health concerns, the failure to permit the revision of school health standards, essentially raising them up to the standards already existing for other buildings, is very troubling.

#6 Replacing Very Old Crumbling Schools that do not meet the State Earthquake Safety Code will cost about $40 billion

When we add the $10 billion school health problem to the $23 billion school construction backlog, the total school construction and repair backlog appears to be over $30 billion. However, this does not include the biggest cost of all – rebuilding over half of our dangerous 50 year old schools to prepare for the next major earthquake. This will cost more than $28 billion. However, since it is the older schools that suffer from both health problems and structural problems, the total bill to upgrade every school in our state to the current building and health codes is about $40 billion.

Relocating and Rebuilding Half of All Public Schools to use as Community Emergency Shelters will cost about $28 billion

As we noted above, over half of all schools in Washington state are more than 50 years old. Few if any of these buildings are earthquake proof. Yet half of our 60,000 teachers and one million students are required to spend 180 days per year inside of these unsafe crumbling buildings. This is a serious danger because a recent article in the New Yorker explained that Oregon, Washington and British Columbia may soon be hit with the worst natural disaster in history – a Magnitude (M) 9.0 Mega Earthquake due to a rupture of the Cascade Fault out in the Pacific Ocean. http://www.newyorker.com/magazine/2015/07/20/the-really-big-one

The last major quake in Washington State was the 2001 Nisqually quake which measured 6.3 on the Richter scale. http://seattlecentral.edu/faculty/jhull/richter.html

Since an8.0 earthquake is ten times worse than a 7.0 quake and a 9.0 quake is 10 times worse than a 8.0 quake, a 9.0 Mega Quake is 160 times worse than anything we have ever experienced here in Washington state.