In this report, we will review how the unconstitutional McCleary Levy Swipe Scam doubled property taxes on homeowners and explain how we can cut our property taxes in half simply by honoring our State Constitution!

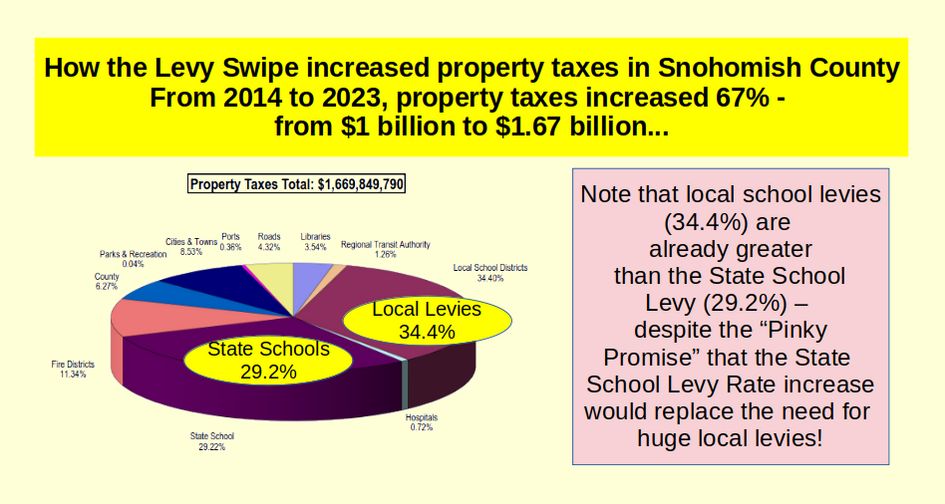

How the McCleary Levy Swipe Scam Increased Property Taxes on Homeowners in Snohomish County

https://snohomishcountywa.gov/DocumentCenter/View/106784/2023-Annual-Report?bidId=

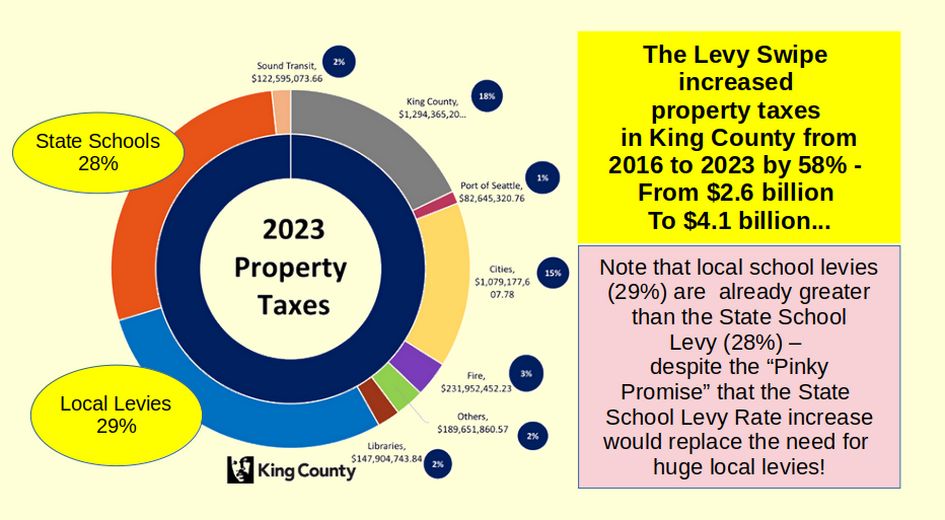

How the McCleary Levy Swipe Scam Increased Property Taxes on Homeowners in King County

https://kingcounty.gov/en/dept/assessor/buildings-and-property/property-taxes/property-tax-overview/past-years-tax-info

History of the McCleary Levy Swipe Scam

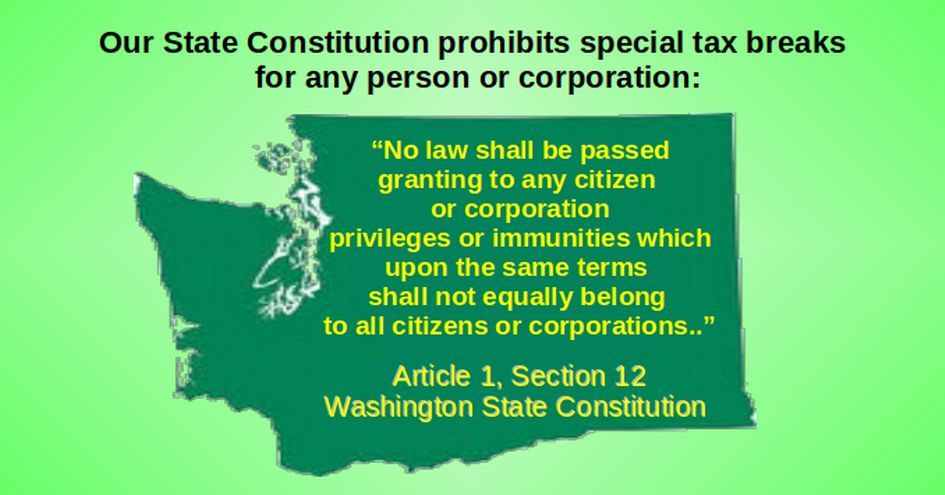

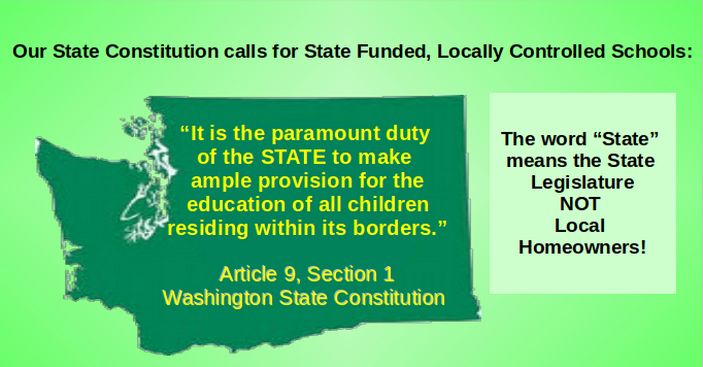

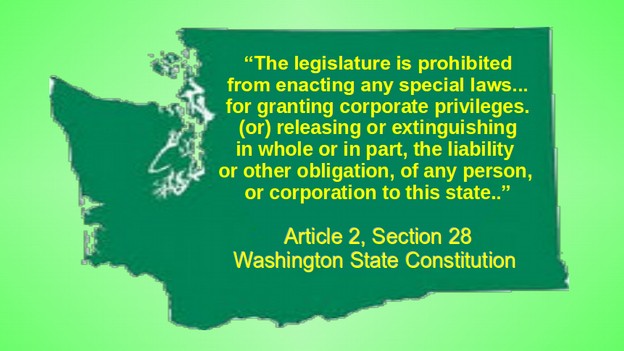

Would you like to know why your property taxes doubled in the past 10 years? Here is why: In 2012, the Washington State Supreme Court found that the Washington State legislature failed to fund our schools as required by Article 9, Section 1 of our State Constitution. At the time, Bill Gates and Microsoft were both getting an annual tax break of more than a billion dollars per year – and Washington was leading the nation in tax breaks for billionaires and wealthy multinational corporations. These tax breaks were clearly in violation of Article 7 Section 1 of the Washington State Constitution which requires a “uniform system of taxes.” These tax breaks also violated several other sections of the Washington State Constitution including Article 2, Section 28 and Article 1, Section 12 which states: “No law shall be passed granting to any citizen or corporation privileges or immunities which upon the same terms shall not equally belong to all citizens or corporations..”

But instead of repealing these unconstitutional billion dollar per year tax breaks, from 2013 to 2016, two of Bill Gates former assistants came up with a different plan. A Democrat Ross Hunter, and his accomplice, a Republican Chad Magendanz, came up with a plan to preserve the billion dollar breaks for Bill Gates and Microsoft by massively increasing property taxes on local homeowners. Ross and Chad called their plan the “Levy Swap” plan. The plan was to increase school funding over 8 years by doubling property taxes on homeowners in King and Snohomish counties. Chad is quite proud of his plan. Here is a quote from his campaign website: “I was a lead negotiator for the McCleary remedy, which resulted in the State increasing its K-12 funding over 8 years by 105%.”

Here is a quote from his campaign flier “Magendanz is recognized as a lead negotiator for the McCleary school funding remedy that doubled state funding for schools over 8 years. “

I, David Spring, was the main opponent of their diabolical plan. I called it the Levy Swipe plan because it used a Shell Game to magically turn billions of dollars in local levy property tax funds into State levy property tax funds – without doing anything to address the actual underlying problem which was the billions of dollars in unconstitutional tax breaks. From 2013 to 2016, I wrote several detailed critiques of their plan explaining why it violated several sections of our State Constitution. I spoke with nearly every member of the House and Senate warning them of these problems.

The biggest problem was that the drafters of our State Constitution wanted a uniform system of Locally Controlled but State Funded schools. The reason for State Funding was to avoid a system of rich schools and poor schools. In addition, they did not want to tax homeowners out of their home. In fact, the only tax break allowed by our State Constitution is a “Homestead” tax break to exempt the average homeowner from having to pay property taxes.

The Hunter-Magendanz Levy Swipe has done just the opposite. It requires State Controlled but Locally Funded schools – with the huge increase in the tax burden placed on homeowners – especially home owners in King and Snohomish counties.

As a result of the Levy Swipe, homeowners in King and Snohomish counties saw their property taxes rise immediately by over 20% - even as funding for their schools actually declined. In the six years since the Levy Swipe, local property taxes have risen by over 70%. They will continue to rise another 30% in the next two years.

On June 30, 2017 at the end of a series of Special Sessions, the legislature passed the Levy Swipe School Funding plan – a 120 page plan that was released just hours before the vote and which few in the legislature even read. Here is a link to this bill:

https://app.leg.wa.gov/billsummary?BillNumber=2242&Year=2017&Initiative=false

While the plan is 120 pages long, it is based on a simple concept. Beginning in 2018, the legislature would rob urban and suburban school districts, mainly in King and Snohomish Counties, of about one billion dollars in “local levy” funds (paid for with property taxes of King and Snohomish County homeowners), change the name of this billion dollars to “state levy” funds and then spreads this money around to more rural school districts. I use the word “rob” because these were funds local voters had already approved - under the condition they were used in their own school district – not some other school district.

In trade for stealing a billion dollars per year in local levy funds, a new Local Levy Cap was placed on local levies of $1.50 per thousand. A year later, the legislature increased the Local Levy Cap to $2.50 per thousand. This was a sneaky way to get around the 1977 Seattle 1 School Funding Decision (also called the Doran Decision. See Seattle School District No. 1 v. State, 90 Wn.2d 476, 585 P.2d 71. Here is a link: https://law.justia.com/cases/washington/supreme-court/1978/44845-1.html

The Doran Decision required the State to fund schools rather than local homeowners. In response, the Legislature passed the Levy Lid Act which capped local levies at 10% of State School funding. The Washington Supreme Court agreed that a 10% cap complied with our State Constitution. For about 10 years, the Legislature complied. Sadly, in the 1990’s, the legislature began raising the Levy Lid and improperly transferring the burden for school funding from the State to local homeowners.

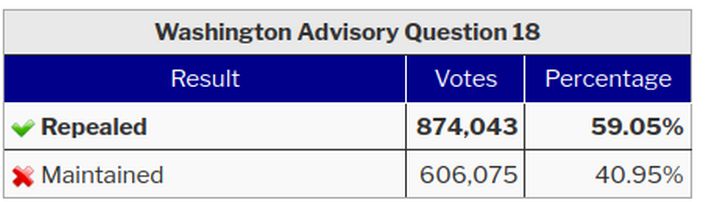

By 2010, the Levy Cap had been raised to more than 30% - which meant that school levies started failing all over the State. A cap of $2.50 per thousand, as a ratio of State spending is roughly a cap of 25% or two and a half times greater than the amount allowed under our State Constitution. Thus, on November 7, 2017, in an Advisory Vote, voters rejected the Hunter-Magendanz Levy Swipe Scam by a wide margin:

Also, in the special school funding elections on February 13, 2018, school funding levies went down to defeat in several school districts in King County including Tahoma, Snoqualmie Valley and Kent as well as Snohomish County school districts Darrington, Lake Stevens, Marysville and Snohomish. Altogether more than 50,000 students in Washington state were adversely affected by the voter rebellion against the Hunter-Magendanz Levy Swipe Scam.

Even before the “Emergency” school closures in March 2020 the legislature’s McCleary solution was falling apart. In 2020, combined State and Local Property taxes on local homeowners were 30% to 50% higher than they were in 2017 – leading to many local levy failures. To make matters worse, since 2020, WOKE policies, Mask Mandates and ridiculous ZOOM classes drove a huge number of parents to pull their kids out of public schools and into private schools and home schooling. This led to even greater declines in school funding.

In March 2020 Congress passed the first pandemic stimulus and created the Elementary and Secondary School Emergency Relief Fund, known as ESSER for short. The 2020 bill gave schools across America $13 billion in funding. In December 2020 Congress passed a second stimulus bill which created ESSER II, allocating $54 billion for schools. Finally, in March 2021, Congress passed the American Rescue Plan, which allocated $122 billion for schools. Washington State got about $4 billion of this one time funding. Sadly, instead of using it to lower class sizes, school boards were blackmailed into spending it on unsustainable teacher pay raises. In 2023, when the one time federal funds went away, more than a thousand teachers had to be fired to make up the budget shortfall. Even more teachers will need to be fired in the Spring of 2024. As more school levies fail and more teachers are fired, class sizes will rise all across Washington State.

While I succeeded in convincing many Republican and Democratic legislators to vote against the Levy Swipe in 2017, both Jim Walsh and Brad Klippert voted for the Levy Swipe. I do not blame them for voting for the Levy Swipe as it did increase school funding in their districts without raising property taxes in their districts. But I spent several years warning everyone in Olympia that this Levy Swipe scam was not only against the State Constitution, it would eventually turn into a disaster for our schools and our home owners.

Among the homeowners most harmed by the Levy Swipe were the home owners in Ross Hunter’s district (Bellevue) and the home owners in Chad Magendanz district (Issaquah). Why did Hunter and Magendanz turn their backs on the homeowners in their own districts? The answer is that they really just represent Bill Gates and Microsoft. The Levy Swipe was never about school funding. It was about protecting billions of dollars in illegal tax breaks for Microsoft and Bill Gates. As a reward for his efforts, Ross Hunter was appointed by Inslee to head another scam called the Department of Early Learning – despite Ross not having any kind of training in Child Development. Chad Magendanz was not so lucky. He lost his seat in the 2016 election.

Understanding the Levy Swipe Shell Game

The Levy Swipe Scam is like a Magic Trick. You take a billion dollars from the right hand and put it in the left hand and suddenly you have a billion dollars in “new” state funding. But we will call the Levy Swipe a “shell game” instead of a magic trick because the Levy Swipe is not merely intended to fool people about where the money is coming from, it is also intended to confuse and rob homeowners while also robbing our schools and kids. Magic tricks do not rob people. Only shell games do that. You think that school funding money is under one shell only to find that it has suddenly disappeared – there is no school funding under any of the shells!

My Plan to Cut our Property Taxes in Half Simply by Honoring our State Constitution

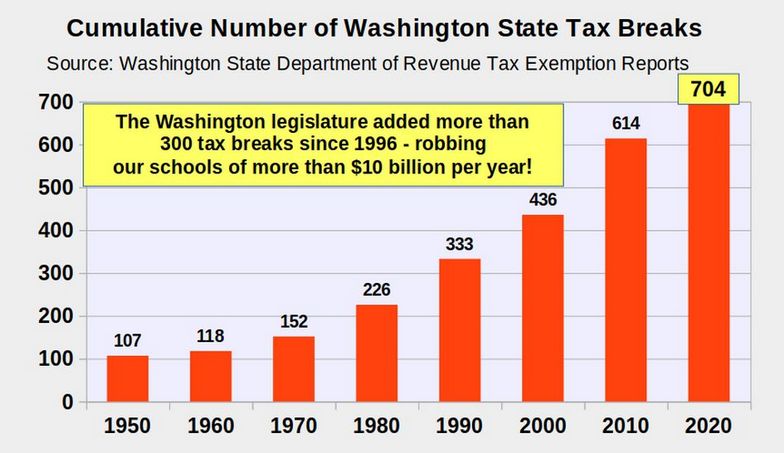

I have spent 20 years teaching courses in Problem Solving at Bellevue College. In order to solve any problem, one has to understand the underlying cause of the problem. In the case of the lack of school funding here in Washington state, the underlying cause is that during the past 20 years our legislature has passed more than 700 tax breaks, called Tax Exemptions – with new tax exemptions being added by the legislature every year. These tax exemptions currently total more than $25 billion dollars per year – meaning that for every dollar our legislature spends on school funding, they spend two dollars on tax breaks for wealthy corporations. This is despite the fact that these tax breaks are specifically prohibited by our State Constitution!

The simple reason the legislature passed a Levy Swipe bill that transferred the tax burden for school funding onto the backs of local homeowners was and is to protect all of these tax breaks for billionaires. It is basic math. Every time the legislature wants to pass another tax break for wealthy corporations, they need to reduce funding somewhere else. For the past 20 years, that some place else has been to cut school funding. This is why we now have some of the highest class sizes in the nation.

How do we fund our schools without placing a monstrous property tax burden on homeowners in King and Snohomish Counties?

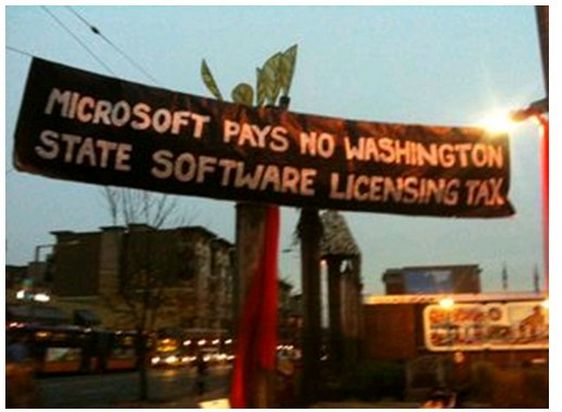

The 2017 Levy Swipe illegally increased property taxes on homeowners in Snohomish County by just under $1 billion dollars per year and illegally increased property taxes on homeowners in King County by just under $2 billion per year. So we need to find $3 billion per year to replace the Levy Swipe funds. The most obvious place to get the first billion is by repealing the illegal Microsoft Tax break.

The Microsoft Tax break is basically letting Microsoft pretend they are located in Reno Nevada instead of Redmond Washington.

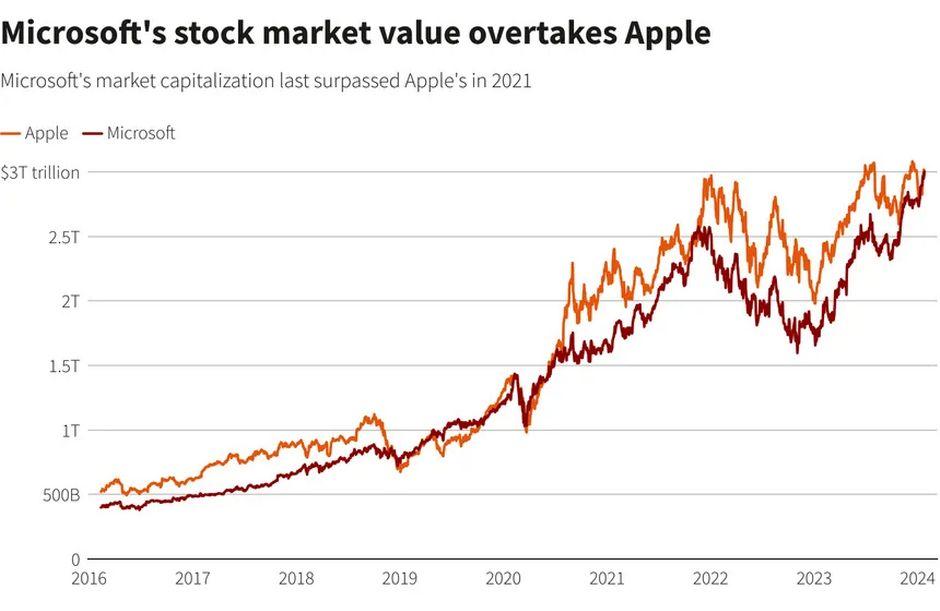

The actual location of Microsoft is Redmond, Washington – and the location of their server farm is in Quincy Washington. So the real reason property taxes were jacked up on homeowners in King and Snohomish counties was to protect billions of dollars in tax breaks for the richest corporation in the history of the world. Is there anyone who actually believes that a corporation worth THREE TRILLION dollars can not afford to pay their fair share of state taxes?

The Microsoft tax break is only one of 700 tax breaks that rob the rest of us tax payers of about $25 billion per year. All of these tax breaks are illegal because they violate several sections of our State Constitution.

Why Tax Breaks are Prohibited by our State Constitution

In 1889, the 75 delegates who drafted our State Constitution were determined to see to it that the State provided ample funding for our public schools. This was why they put into our State Constitution a clause making it the Paramount Duty of the State to amply fund our schools. In fact, the Washington State Constitution is the only constitution in the nation to make it the Paramount Duty of the entire State to amply fund our public schools.

Does our Supreme Court have the power to repeal tax breaks?

Our State Constitution has several clauses prohibiting the legislature from granting tax breaks to private corporations. The problem with granting 700 tax breaks to wealthy corporations, besides the fact that these billions in tax breaks make it impossible to fully fund our schools, is that these tax breaks create a non-uniform system of taxes whereby local homeowners pay a much higher percentage of taxes than wealthy multinational corporations. Put another way, even if the legislature had fully complied with their Paramount Duty to amply fund our public schools, tax breaks to wealthy corporations would still be against the Washington State Constitution.

Throughout the State Constitution, there are several clauses that indicate that granting tax breaks to private corporations is unconstitutional. Here are just three of those clauses.

Article 2, SECTION 28 SPECIAL LEGISLATION. The legislature is prohibited from enacting any private or special laws... Here are three of several clauses prohibiting tax breaks to corporations:

5. For assessment or collection of taxes, or for extending the time for collection thereof.

6. For granting corporate powers or privileges.

10. Releasing or extinguishing in whole or in part, the indebtedness, liability or other obligation, of any person, or corporation to this state.

Every tax break passed by the Washington legislature is a clear violation of Article 2, Section 28 of our State Constitution. Despite this fact, no other state in the nation grants tax breaks to wealthy corporations to the extent that the Washington legislature has granted tax breaks to wealthy corporations.

The total is now more than $30 billion per year. In granting 700 tax exemptions, some of which apply to only a single corporation, such as Microsoft or Boeing, our state legislature has created laws that clearly violate the uniformity clause of Article 7, Section 1 of our State Constitution. These special tax breaks are not legal even if the Constitution did not have a Paramount Duty clause. But when we also consider the Paramount Duty clause and how hard the drafters of our State Constitution worked to prevent corporate corruption in our state, the existence of these 700 illegal tax breaks adds insult to injury.

Even after our Supreme Court ruled in 2012 that our public schools were not being amply funded (something obvious to any parent or teacher), the legislature continued to enact even more tax breaks - including a new $9 billion tax break for Boeing that was the largest tax break in the history of the planet.

Our State Constitution was written by people who deeply feared that a corrupt legislature would refuse to fund our public schools. So they put several clauses in our State Constitution specifically to take power AWAY from the legislature and put it in the hands of independently elected people with the hope that they would force the legislature to fund our schools. This is exactly where we are today. Our legislature has continued to place corporate tax breaks above their duty to fund our schools despite sanctions from our Supreme Court. In January 2012, just weeks after our Supreme Court found that the legislature had failed meet their Constitutional duty to fund the public schools the legislature renewed $2.2 billion in corporate tax breaks – in a single afternoon! I know because I was there and I spoke against renewing these $2.2 billion in tax breaks.

Here is a quote from the McCleary Plaintiff’s brief: “The State’s putting tax exemptions for the private sector ahead of ample funding for its public schools is not new. For example, after this Court’s January 2012 decision made the meaning of the State’s “paramount duty” unequivocally clear, the 2013 legislature focused instead on a special session to give an airplane company a multi-billion dollar tax break. All told, the State’s recent tax exemption study reported that 694 of the tax exemptions handed out by the State totaled $50.4 billion in the 2015-2017 biennium – with 114 of those exemptions enacted after the January 2007 filing of this suit. The State’s paramount constitutional duty is ample K-12 funding – not tax exemptions… “

We will never be able to fully restore school funding until we get rid of these dishonest and illegal tax breaks. We cannot allow our legislature to give away more than $25 billion per year in tax breaks for wealthy corporations and still have enough money left to fully fund our schools and lower class sizes. In addition to restoring local control of schools, we should work to repeal the massive tax breaks. The result will be that local property taxes on home owners can be cut in half – back to what they were 10 years ago.

This is my pledge to home owners. I will hold the legislature’s feet to the fire – to cut the property tax burden on local home owners in half by insisting that the legislature repeal billions in illegal tax breaks they currently give to billionaires and wealthy corporations.

Conclusion: The Future of our Schools is in Your Hands

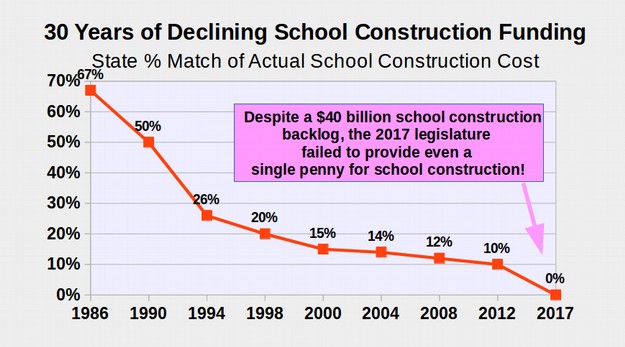

School funding includes providing every student with a safe and healthy classroom. Currently over half of our schools are over 50 years old and do not meet the health codes or earthquake code standards. Many of these schools do not even have safe drinking water. Think Flint Michigan only on a massive scale. Here is a quote on this disgraceful situation.

“In 2009, Washington adopted a rule that would require testing school water for lead. But the rule never went into effect because the Legislature hasn’t found the money to pay it. Instead, like other education expenses in this state, whether your child’s school is testing its water depends on your ZIP code. . . . House Bill 1925 would require testing of all drinking and cooking water inside schools, while outlining reasonable and affordable mitigation if lead is found.” http://www.seattletimes.com/opinion/editorials/school-water-safety-should-be-a-higher-priority/

Even more shocking, despite our schools facing a $40 billion school construction and repair backlog, the 2017 Washington legislature failed to provide even a single penny for school construction and repair:

With the passage of the Levy Swipe bill that is certain to reduce school funding rather than increase it, our current legislature has made it crystal clear that they have no intention of honoring their Paramount Duty to amply fund our public schools. The only question left is what can we do as citizens, parents and teachers to restore school funding here in Washington state.

It is time to end bribes and kickbacks in Olympia

The time has come to end this corruption in Olympia. We need to inform every parent and every teacher in our State about the drawbacks of the Levy Swipe Scam. The first step is to share this article with other parents and teachers. Email it to friends. Print off a flier and pass it around at your local PTA meeting. Hold a discussion on school funding at your local library. Here is a direct link to download this report: https://springforbetterschools.org/free-downloads

It is time to stop hoping that someone else will solve this problem. The future of our kids and our schools is up to everyone of us to take direct action now. As always, I look forward to your questions and comments.

Regards,

David Spring M. Ed.

David (at) SpringforBetterSchools (dot) org